In the intricate world of credit, the value of a co-signer cannot be overstated. Co-signers afford crucial support, paving the way for individuals to access

Category: Managing Credit

Master the art of managing your credit with strategies and insights designed to help you maintain a healthy credit profile. This category offers guidance on effectively using credit cards, understanding the nuances of interest rates, and managing your debt to optimize your credit score. Learn how to leverage credit utilization, navigate the complexities of various credit products, and make informed decisions that align with your financial goals. Whether you’re aiming to maximize rewards, reduce debt, or maintain a strong credit history, our tips on managing credit can empower you to achieve financial stability and unlock new opportunities.

Embarking on the journey to financial stability often begins with understanding how to improve credit with a credit builder loan. In a climate where creditworthiness

Embarking on higher education is an exhilarating chapter in life, yet it often comes with the daunting reality of student loans. These loans are more

Embarking on the journey of adulthood brings with it a vital financial milestone—establishing credit history. For millennials taking their first steps in building credit from

For many, achieving financial security starts with the fundamental step of credit building. It’s about more than just a number; it’s a reflection of one’s

As Americans face increasing credit card balances, the quest for effective strategies to pay off credit card debt has never been more urgent. Escaping the

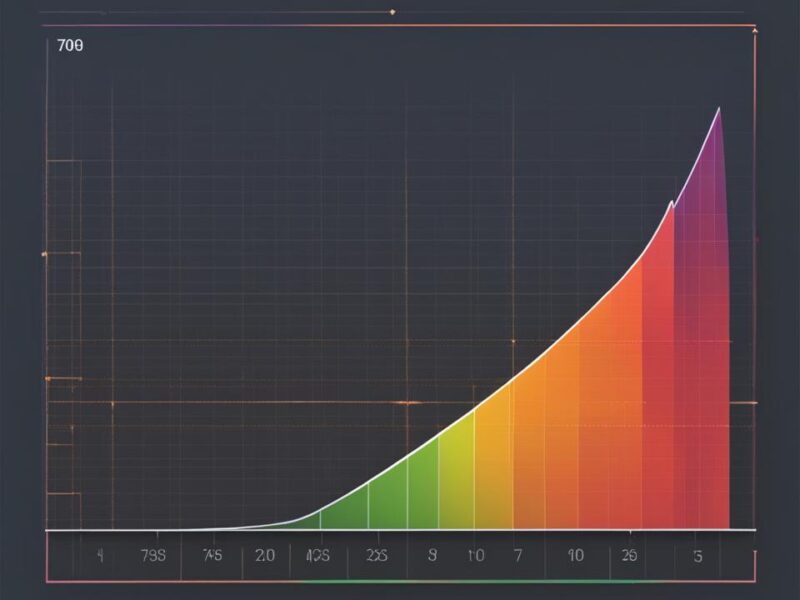

Understanding your Credit Utilization is a significant aspect of managing your overall Credit Health. This potent marker represents the percentage of available Revolving Credit that

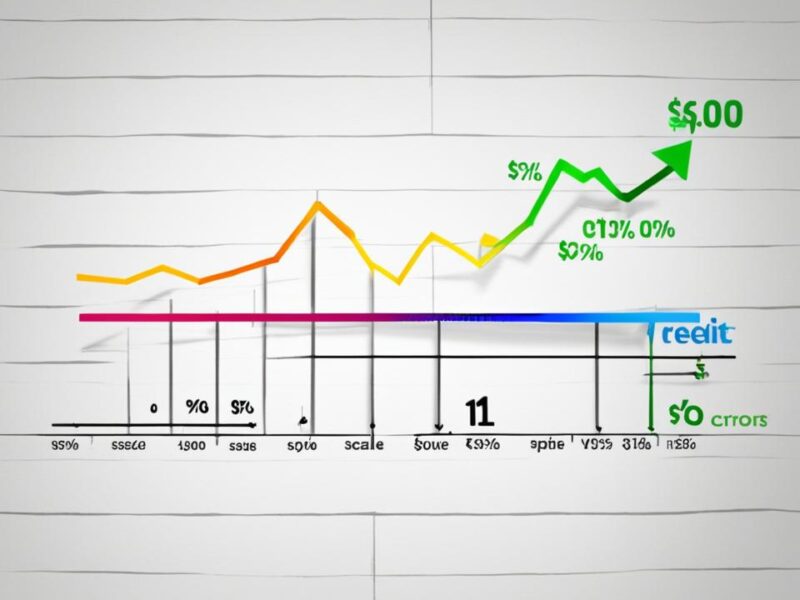

Amid a shifting economic landscape, the Federal Reserve’s recent decision to increase interest rates heralds a pivotal turn for credit cost management. This move, marking

Navigating today’s economy, the significance of a robust credit history cannot be overstated. The ability to unlock financial opportunities hinges on a crucial three-digit number:

Understanding credit reports is more than a necessity; it’s a pivotal step in managing one’s financial journey. These detailed documents not only reflect an individual’s