If you’re considering buying a house, one of the key factors to consider is your credit score. Your credit score plays a critical role in determining your eligibility for a home loan and the terms you’ll be offered. But what credit score is needed to buy a house?

The ideal credit score for homebuyers can vary depending on the type of mortgage loan and the lender you’re working with. While it’s possible to get a mortgage with a credit score as low as 500, you’ll generally need a good or exceptional credit score to qualify for the best terms and interest rates.

Let’s explore the credit score requirements for buying a house and what you need to know before embarking on your homebuying journey.

Key Takeaways:

- The minimum credit score needed to buy a house can range from 500 to 700, depending on the lender and the type of mortgage loan.

- While it’s possible to get a mortgage with bad credit, having a good or exceptional credit score increases your chances of qualifying for the best terms and interest rates.

- Your credit score affects the interest rate and payment terms on your mortgage loan, with higher scores generally leading to lower interest rates.

- If you have a low credit score, there are options available, such as FHA loans, making a larger down payment, and working with a mortgage broker.

- To prepare your credit for a mortgage, check your credit score and reports, pay down debt, and avoid opening new credit accounts.

What Credit Score Do I Need to Get a Mortgage?

When it comes to getting a mortgage, your credit score plays a crucial role in determining your eligibility and the terms of your loan. Different types of mortgages have varying minimum credit score requirements set by lenders. It’s important to understand these credit score requirements before starting the home loan application process. Here’s a breakdown of the minimum credit scores needed for each type of mortgage:

- Conventional Loans: Minimum Credit Score – 620

- Jumbo Loans: Minimum Credit Score – 700

- FHA Loans: Minimum Credit Score – 500

- VA Loans: Minimum Credit Score – 620

- USDA Loans: Minimum Credit Score – 580

It’s important to note that apart from credit scores, lenders may also have additional criteria to assess your creditworthiness. However, having a credit score above the minimum requirement can increase your chances of qualifying for a mortgage and securing more favorable loan terms.

To get a better understanding of the credit score requirements for different types of mortgages, Table 2 provides a concise summary:

| Mortgage Type | Minimum Credit Score |

|---|---|

| Conventional Loans | 620 |

| Jumbo Loans | 700 |

| FHA Loans | 500 |

| VA Loans | 620 |

| USDA Loans | 580 |

How Your Credit Score Affects Mortgage Rates

Your credit score plays a crucial role in determining the interest rate and payment terms on a mortgage loan. Lenders use a risk-based pricing model to assess your creditworthiness and determine the level of risk they are taking by lending you money.

When it comes to mortgage rates, the impact of your credit score is significant. The higher your credit score, the lower the interest rate you’re likely to qualify for. This is because a higher credit score indicates a lower level of risk to the lender.

Lenders view borrowers with higher credit scores as more likely to make their mortgage payments on time and in full. As a result, they reward these borrowers with lower interest rates, which can save you thousands of dollars over the life of your mortgage.

For example, let’s consider two borrowers:

Borrower A has a credit score of 760, while Borrower B has a credit score of 620.

Based on their credit scores, Borrower A may qualify for a mortgage rate of 3.50%, while Borrower B may be offered a rate of 4.50%.

This seemingly small difference in interest rates can have a significant impact on the total cost of the loan.

The Impact of Credit Score on Mortgage Rates

| Credit Score Range | Estimated Mortgage Rate |

|---|---|

| 760+ | 3.50% |

| 700-759 | 3.75% |

| 680-699 | 4.00% |

| 660-679 | 4.25% |

| 640-659 | 4.50% |

| 620-639 | 4.75% |

| Below 620 | 5.00% |

As you can see from the table, the correlation between credit score and mortgage rate is clear. The difference in interest rates among different credit score ranges can have a substantial impact on your monthly mortgage payments and the total amount you pay over the life of the loan.

Therefore, it’s important to work on improving your credit score before applying for a mortgage. Paying your bills on time, keeping your credit card balances low, and reducing your overall debt can all help boost your credit score and potentially qualify you for a better mortgage rate.

Can You Get a Mortgage With a Bad Credit Score?

While having a bad credit score may make it more challenging to get approved for a mortgage, it is still possible to secure a home loan. However, it’s essential to note that having a low credit score may result in higher interest rates and less favorable terms.

Here are some options to consider if you’re looking to get a mortgage with bad credit:

- Apply for an FHA loan: FHA loans are designed to help individuals with lower credit scores secure financing. The minimum credit score requirement for an FHA loan can vary but is typically around 500. Keep in mind that a higher down payment may be required.

- Make a large down payment: Making a substantial down payment can help offset the impact of a low credit score. Lenders may be more willing to approve your mortgage application if you demonstrate a significant financial commitment.

- Get preapproved with multiple lenders: Shopping around and getting preapproved with multiple lenders can increase your chances of finding a lender who is willing to work with your credit situation. Different lenders may have different eligibility criteria and may offer more flexible terms.

- Work with a mortgage broker: Mortgage brokers have access to a wide network of lenders and can help you navigate the lending landscape. They can assist you in finding lenders who specialize in working with borrowers with bad credit.

- Pay down large credit card balances: Lowering your credit card balances can help improve your credit utilization ratio, which is an important factor in calculating your credit score. Aim to keep your credit card balances below 30% of your available credit limit.

- Pay down other debts: Besides credit card balances, reducing other outstanding debts, such as personal loans or auto loans, can help improve your overall credit profile.

- Ask someone with good credit to cosign: Having a cosigner with a strong credit history can increase your chances of getting approved for a mortgage. Keep in mind that the cosigner will be equally responsible for the loan and that their credit will also be impacted by the mortgage.

By considering these options and taking steps to improve your creditworthiness, you can enhance your chances of obtaining a mortgage, even with a bad credit score.

Mortgage Options for Low Credit Score Borrowers

If you have a low credit score and are exploring mortgage options, it’s crucial to understand the loan programs available to borrowers with poor credit. While traditional lenders may have stricter requirements, certain lenders specialize in offering mortgages to individuals with low credit scores.

| Lender | Minimum Credit Score | Key Features |

|---|---|---|

| ABC Mortgage | 550 | Competitive interest rates for borrowers with poor credit |

| XYZ Bank | 580 | Flexible down payment options and personalized loan terms |

| DEF Lending | 500 | Specializes in FHA loans for low credit score borrowers |

“Even with bad credit, there are lenders who specialize in working with borrowers with low credit scores. These lenders are willing to consider other aspects of your financial profile beyond just your credit score.”

Remember, while these lenders offer options for individuals with poor credit, it’s still important to work on improving your credit score to access better loan terms and interest rates in the future. Paying bills on time, reducing debt, and regularly monitoring your credit report can all contribute to building a healthier credit profile.

How to Prepare Your Credit for a Mortgage

If you’re thinking about buying a home soon, it’s important to ensure that your credit is in good shape before you start the mortgage application process. Taking the time to prepare your credit can improve your chances of qualifying for a favorable home loan. Here are some steps you can take to boost your credit readiness for a house purchase:

- Check your credit score and reports: Start by obtaining a copy of your credit report and checking your credit score. Look for any errors or inaccuracies that could negatively impact your creditworthiness.

- Pay down debt: Lowering your overall debt-to-income ratio can improve your credit score and increase your chances of being approved for a mortgage. Focus on paying off high-interest debts first.

- Avoid applying for new credit: Each time you apply for new credit, it can temporarily lower your credit score. Avoid taking on new credit until after you have secured your mortgage.

- Consider waiting if you have significant negative items: If you have significant negative items on your credit report, such as recent bankruptcies or foreclosures, it may be beneficial to wait until they have dropped off your report before applying for a mortgage. This can improve your chances of getting approved and receiving better loan terms.

- Think beyond just the loan terms: While getting a low-interest rate is important, don’t forget to consider other factors, such as the down payment required, closing costs, and overall affordability. Make sure you have a clear understanding of the financial responsibilities associated with homeownership.

By following these steps and being proactive in preparing your credit for a mortgage, you can increase your chances of securing a home loan with favorable terms and improving your creditworthiness in the long term.

| Credit Preparation Steps | Importance |

|---|---|

| Check your credit score and reports | Identify any issues or errors |

| Pay down debt | Improves credit score and shows financial responsibility |

| Avoid applying for new credit | Prevents temporary lowering of credit score |

| Consider waiting if you have significant negative items | Improves chances of better loan terms |

| Think beyond just the loan terms | Consider overall affordability and financial responsibilities |

Average Credit Scores for Homebuyers

When it comes to buying a home, understanding average credit scores is important. Knowing what is considered a typical credit score for a home purchase can help you gauge your own creditworthiness and eligibility for a mortgage loan.

According to data from Credit Karma, the average credit score for homebuyers in 2022 was 705. However, it’s essential to note that this average can vary depending on various factors such as location, loan type, and individual lender requirements. While 705 may be the average credit score, it’s not necessarily the minimum requirement.

To give you a better understanding of credit score statistics for house buyers, here’s a breakdown:

| Loan Type | Minimum Credit Score |

|---|---|

| Conventional Loans | 620 |

| Jumbo Loans | 700 |

| FHA Loans | 500 |

| VA Loans | 620 |

| USDA Loans | 580 |

These minimum credit scores provide a general guideline for the credit score requirements of different loan types. However, it’s vital to note that individual lenders may have their own specific requirements within these ranges.

Remember, credit scores are just one factor lenders consider when evaluating your mortgage application. Other factors such as income, employment history, and debt-to-income ratio are also taken into account.

Keeping your credit score in good shape is crucial for securing the best mortgage terms and interest rates. If your credit score is below the desired threshold, it’s worth taking steps to improve it before applying for a mortgage loan. Paying bills on time, reducing debt, and avoiding new credit applications are some strategies that can help boost your credit score.

Quotes:

“Understanding your credit score and the average credit scores for homebuyers can give you a better sense of where you stand in the homebuying process.” – Financial Advisor

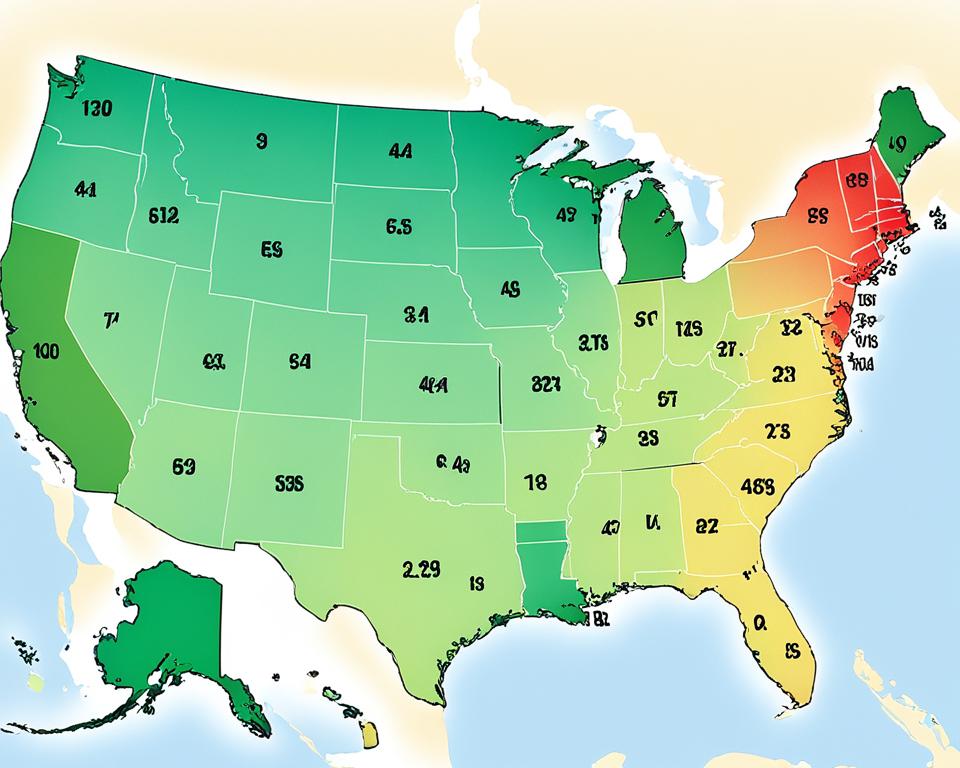

Credit Scores by State for Homebuyers

When looking at credit scores for homebuyers by state, there is significant variation across the United States. Different states have different average credit scores for homebuyers, which can impact the homebuying process and loan terms.

States like Oregon, Hawaii, and Washington tend to have higher average credit scores for homebuyers. These states have populations with good credit health, indicating responsible financial habits and a track record of timely payments. Homebuyers in these states may have an advantage when it comes to securing favorable loan terms and interest rates.

On the other hand, states like Arkansas, Mississippi, and Louisiana tend to have lower average credit scores for homebuyers. Factors such as a higher population of subprime borrowers, economic conditions, and access to credit education resources can contribute to lower average credit scores. Homebuyers in these states may face more challenges when it comes to securing mortgage loans and may encounter higher interest rates or stricter lending criteria.

It’s important for prospective homebuyers to be aware of the average credit scores in their respective states. Understanding the credit landscape in your state can give you valuable insights into your own creditworthiness and help you make informed decisions when applying for a mortgage.

Having a good credit score is crucial when it comes to buying a home. It not only affects your ability to qualify for a mortgage but also influences the terms and interest rates you may receive. By actively working towards improving your credit score and understanding the credit landscape in your state, you can position yourself for success in the homebuying journey.

Credit Scores by City for Homebuyers

When it comes to credit scores for homebuyers by city, there are notable differences in average credit scores among homebuyers across different cities in the United States. Some cities have higher average credit scores among homebuyers, while others have lower averages.

In cities like San Francisco, Seattle, and Irvine, homebuyers tend to have higher average credit scores. These cities are known for their competitive housing markets and higher cost of living, which may attract individuals with strong credit histories and higher incomes.

“San Francisco’s robust economy and high-paying job opportunities often attract homebuyers with excellent credit scores and financial stability.” – Mortgage Expert

On the other hand, cities like Milwaukee, Memphis, and Laredo tend to have lower average credit scores among homebuyers. These cities may have different economic factors and affordability levels, leading to a larger proportion of homebuyers with lower credit scores.

“Cities like Milwaukee often have more affordable housing options, which can attract a broader range of homebuyers, including those with lower credit scores.” – Real Estate Agent

It’s important to note that credit scores can vary substantially at an individual level, even within the same city. The average credit scores mentioned here are based on available data and should be seen as general trends rather than definitive measures.

Average Credit Scores by City for Homebuyers

| City | Average Credit Score |

|---|---|

| San Francisco | 740 |

| Seattle | 730 |

| Irvine | 720 |

| Milwaukee | 680 |

| Memphis | 670 |

| Laredo | 660 |

Note: The average credit scores listed above are approximate figures and may vary depending on the data source.

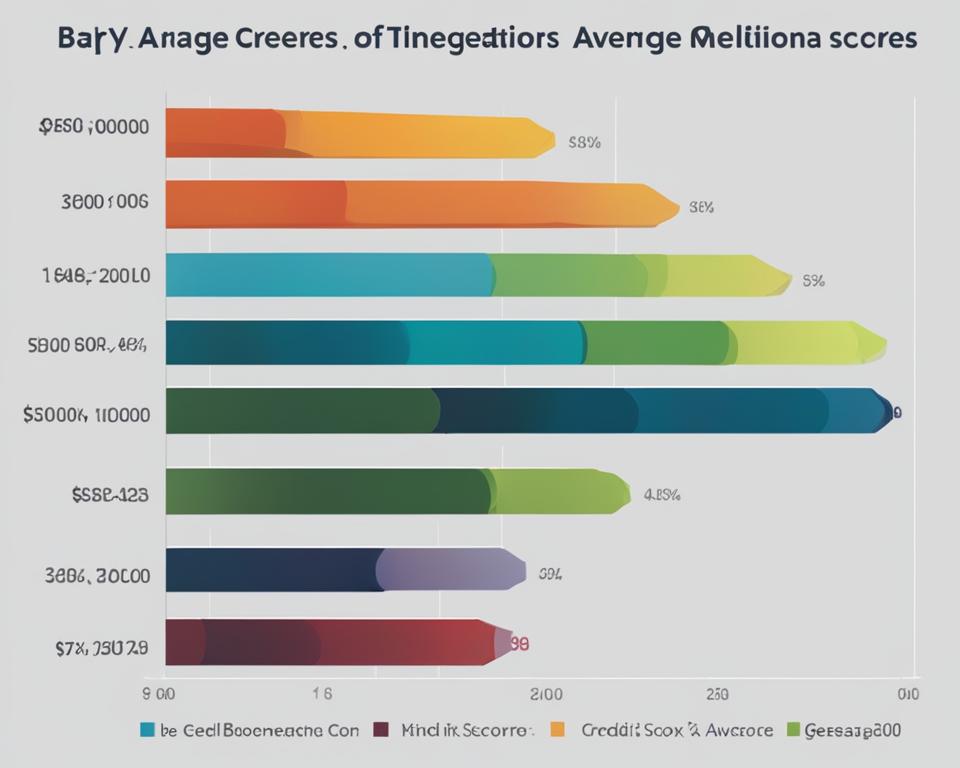

Credit Scores by Generation for Homebuyers

When examining credit scores for homebuyers by generation, it was found that baby boomers tend to have the highest average credit scores among homebuyers, while Gen Z has the lowest average credit scores. Millennials and Gen Xers have higher average mortgage balances compared to other generations.

| Generation | Average Credit Score | Average Mortgage Balance |

|---|---|---|

| Baby Boomers | 750 | $250,000 |

| Gen X | 720 | $200,000 |

| Millennials | 690 | $220,000 |

| Gen Z | 660 | $180,000 |

As the table demonstrates, baby boomers have an average credit score of 750, positioning them as the generation with the highest credit scores among homebuyers. Gen X follows closely with an average score of 720. Millennials and Gen Z, on the other hand, have relatively lower credit scores, with averages of 690 and 660 respectively.

Interestingly, while baby boomers have the highest credit scores, millennials and Gen Xers tend to have higher average mortgage balances. This data suggests that while credit score plays a significant role in homebuying, other factors such as income and financial circumstances also influence the size of the mortgage individuals in different generations are taking on.

It’s important to note that these figures are averages and individual experiences may vary. Factors such as location, income, and individual financial profiles can impact credit scores and mortgage balances for homebuyers across generations.

Average Mortgage Balance by Credit Score

When it comes to mortgage balances, there is a clear relationship between credit scores and the amount borrowed. Credit Karma’s data reveals that individuals with higher credit scores tend to have higher average mortgage balances, while those with lower credit scores have lower balances.

“Your credit score can significantly impact the amount you can borrow for a mortgage. Lenders consider credit scores as a measure of creditworthiness and use it to determine the risk associated with lending to you.”

Let’s take a closer look at the average mortgage balances based on credit scores:

| Credit Score | Average Mortgage Balance |

|---|---|

| Prime or Super Prime (760-850) | $300,000 |

| Good (700-759) | $250,000 |

| Fair (640-699) | $200,000 |

| Subprime or Near Prime (580-639) | $150,000 |

As shown in the table, individuals with prime or super prime credit scores have an average mortgage balance of $300,000. On the other hand, those with subprime or near prime credit scores have a lower average mortgage balance of $150,000.

This relationship between credit score and mortgage balance is a result of lenders considering creditworthiness and risk when determining loan amounts and terms. Individuals with higher credit scores are often seen as less risky borrowers, allowing them to secure larger mortgages.

It’s important to note that these figures are averages and individual circumstances may vary. Factors such as income, down payment, and debt-to-income ratio also play a role in determining the mortgage amount.

By maintaining a good credit score, you can increase your chances of securing higher mortgage amounts and favorable terms. This can make a significant difference in your ability to purchase the home of your dreams.

Minimum Credit Scores for Different Types of Mortgages

When it comes to securing a mortgage, understanding the minimum credit score requirements is essential. The credit score needed to qualify for different types of mortgages can vary. Let’s take a look at the minimum credit scores required for some common mortgage options:

FHA Loans

An FHA loan is a popular choice for many first-time homebuyers as it offers more flexible qualification criteria. To be eligible for an FHA loan, a minimum credit score of 500 is required, but with a credit score between 500 and 579, a higher down payment of at least 10% is typically necessary. If your credit score is 580 or higher, you may qualify for an FHA loan with a down payment as low as 3.5%.

Conventional Loans

Conventional loans are another common type of mortgage. The minimum credit score required for a conventional loan is usually 620. However, keep in mind that lenders may have different credit score requirements based on factors such as the loan amount and your financial profile.

VA Loans

VA loans are available to eligible veterans, active-duty service members, and their surviving spouses. These loans typically have more lenient credit requirements compared to conventional loans. While there is no specific minimum credit score requirement for VA loans, most lenders prefer borrowers with a credit score of 620 or higher.

Remember that while these are the general guidelines, individual lenders may have their own credit score requirements, so it’s important to shop around and compare offers to find the best mortgage option for your financial situation.

Having a good credit score is crucial when applying for a mortgage. A higher credit score not only improves your chances of approval but can also lead to better interest rates and loan terms. If your credit score falls below the minimum requirements, consider taking steps to improve it before applying for a mortgage.

The Relationship Between Credit Score and Interest Rate

While a specific credit score doesn’t guarantee a certain mortgage rate, credit scores generally have a predictable overall effect on mortgage rates. People with higher credit scores tend to qualify for lower interest rates, while those with lower credit scores may face higher interest rates.

Having a good credit score is important when it comes to applying for a mortgage. Lenders consider your credit score to assess your creditworthiness and determine the terms of your loan. A higher credit score indicates a lower risk profile, making you a more attractive borrower. As a result, lenders are more likely to offer you a lower interest rate.

On the other hand, borrowers with lower credit scores may be seen as higher risks, resulting in higher interest rates to compensate for the increased likelihood of default. Lenders may be hesitant to offer favorable terms and may require higher down payments or additional collateral when extending loans to borrowers with lower credit scores.

It’s important to note that the impact of credit score on mortgage rates can vary depending on other factors as well. Lenders consider multiple factors when determining interest rates, including the loan-to-value ratio, debt-to-income ratio, and the borrower’s overall financial stability. However, credit score remains a key factor in the decision-making process.

Improving your credit score can have a significant impact on your mortgage interest rate. By taking steps to establish a positive credit history, paying bills on time, and reducing outstanding debt, you can work towards achieving a higher credit score. This, in turn, can help you secure a mortgage with a lower interest rate and potentially save you thousands of dollars over the life of your loan.

A visual representation of the correlation between credit score and mortgage interest rate can be seen in the table below:

| Credit Score Range | Estimated Interest Rate |

|---|---|

| Excellent (750+) | 3.25% |

| Good (700-749) | 3.75% |

| Fair (650-699) | 4.25% |

| Poor (600-649) | 5.25% |

| Very Poor (Below 600) | 6.50% |

Please note that these figures serve as estimates and can vary depending on other factors. It’s always best to consult with a mortgage professional to determine the specific interest rate you may be eligible for based on your credit score and other individual circumstances.

The Importance of Credit Score in the Mortgage Application Process

Your credit score plays a significant role in the mortgage application process. Lenders use credit scores to assess your creditworthiness and determine the terms of your mortgage loan. A higher credit score can increase your chances of qualifying for a mortgage and improve the terms you are offered.

When you apply for a mortgage, lenders consider various factors to determine your eligibility. One of the most important factors is your credit score. Your credit score is a numeric representation of your creditworthiness, based on your credit history and financial behavior. It indicates how likely you are to repay your debts on time.

Lenders use credit scores to evaluate the level of risk they assume by lending you money. A higher credit score suggests that you have demonstrated responsible financial behavior and are more likely to make your mortgage payments in a timely manner. As a result, lenders may offer you better interest rates, lower fees, and more favorable loan terms.

On the other hand, a lower credit score may indicate a higher level of risk for lenders. This could result in higher interest rates, stricter loan requirements, and additional fees. In some cases, a low credit score may even lead to loan denial.

Improving your credit score before applying for a mortgage can significantly impact your eligibility and the terms you are offered. Here are a few steps you can take to improve your credit score:

- Pay your bills on time: Consistently paying your bills by their due dates can demonstrate responsible financial behavior and help boost your credit score.

- Reduce your debt: Paying down your existing debts can lower your credit utilization ratio, which is the amount of credit you are currently using compared to your total available credit. This can positively impact your credit score.

- Avoid opening new credit accounts: Applying for new credit can temporarily lower your credit score. It’s best to avoid opening new accounts while you’re in the process of applying for a mortgage.

- Check your credit reports: Regularly reviewing your credit reports can help you identify any errors or inaccuracies that could be negatively impacting your score. If you find any errors, you can dispute them and have them corrected.

By taking these steps to improve your credit score, you can increase your chances of getting approved for a mortgage and secure more favorable loan terms. It’s important to start early and give yourself enough time to make any necessary improvements before applying for a mortgage.

Conclusion

Understanding the credit score requirements for buying a house is crucial for potential homebuyers. Your credit score plays a significant role in the mortgage application process and can impact your ability to secure a home loan with favorable terms.

While the minimum credit score needed can vary depending on factors such as loan type and lender, it’s generally recommended to have a good or exceptional credit score to qualify for the best terms. Lenders typically consider credit scores as an indication of your creditworthiness and ability to repay the loan.

To increase your chances of successfully buying a home, it’s important to prepare your credit before applying for a mortgage. Taking steps to improve your credit score, such as paying down debt, avoiding new credit applications, and checking your credit report for errors, can help strengthen your financial profile.

Remember, a higher credit score can not only improve your chances of getting approved for a mortgage but also open doors to more favorable interest rates and loan terms. Taking the time to build and maintain a good credit score is an investment that can pay off in the long run when it comes to buying the house of your dreams.

FAQ

Q: What credit score is needed to buy a house?

What is the minimum credit score for a home loan?

The minimum credit score for a home loan can vary depending on the loan type. For example, conventional loans typically require a minimum credit score of 620, while FHA loans may accept a score as low as 500.

What is the best credit score for a house purchase?

Ideally, having a good or exceptional credit score is recommended for a house purchase. This will increase your chances of qualifying for the best loan terms and interest rates.

Can you get a mortgage with a bad credit score?

It is possible to get a mortgage with a bad credit score, but you may face higher interest rates and less favorable terms. Options to improve your chances include applying for an FHA loan, making a larger down payment, and working with a mortgage broker.

How can I prepare my credit for a mortgage?

To prepare your credit for a mortgage, you can start by checking your credit score and reports, paying down debt, avoiding new credit applications, and considering waiting if you have significant negative items on your credit report.

What are the average credit scores for homebuyers?

According to Credit Karma, the average credit score for homebuyers in their data set was 705 in 2022. However, the actual average credit score needed can vary based on factors such as location and individual lender requirements.

How do credit scores for homebuyers vary by state?

Credit scores for homebuyers can vary by state. States like Oregon, Hawaii, and Washington tend to have higher average credit scores for homebuyers, while states like Arkansas, Mississippi, and Louisiana tend to have lower average credit scores.

How do credit scores for homebuyers vary by city?

Certain cities have higher average credit scores among homebuyers, such as San Francisco, Seattle, and Irvine. On the other hand, cities like Milwaukee, Memphis, and Laredo tend to have lower average credit scores among homebuyers.

How do credit scores for homebuyers vary by generation?

Baby boomers tend to have the highest average credit scores among homebuyers, while Gen Z has the lowest average credit scores. Millennials and Gen Xers have higher average mortgage balances compared to other generations.

How does credit score impact mortgage rates?

Generally, people with higher credit scores qualify for lower interest rates, while those with lower credit scores may face higher rates. Your credit score plays a significant role in determining the terms and interest rate of your mortgage loan.

What are the minimum credit scores for different types of mortgages?

The minimum credit score requirements can vary for different types of mortgages. For example, FHA loans typically require a minimum credit score of 500 or 580, depending on the down payment amount. Conventional loans may have a minimum credit score requirement of 620.

How important is credit score in the mortgage application process?

Your credit score plays a significant role in the mortgage application process. Lenders use it to assess your creditworthiness and determine the terms of your loan. A higher credit score can increase your chances of qualifying for a mortgage and improve the terms you are offered.