A credit score is a three-digit number used by lenders to determine loan approval. It is an important indicator of an individual’s creditworthiness. However, with multiple credit scoring models available, it can be confusing to understand which credit score matters the most.

When it comes to credit scores, two popular models stand out: FICO® Scores and VantageScores. These scores are calculated using different formulas and consider various factors to assess creditworthiness. The specific credit score that matters most depends on the reason for checking and the type of loan or credit being applied for.

For many lenders, FICO® Scores are the go-to credit scores. They are used in over 90% of lending decisions and are widely accepted by banks, credit card issuers, and other financial institutions. FICO Scores range from 300 to 850 and are calculated based on factors such as payment history, credit utilization, length of credit history, credit mix, and new credit applications.

VantageScores, on the other hand, are gaining popularity. They were developed by the three major credit bureaus – Equifax, Experian, and TransUnion – as an alternative to FICO Scores. Like FICO Scores, VantageScores range from 300 to 850, but they use a different scoring model and consider similar factors, including payment history, utilization rate, credit mix, and length of credit history.

Key Takeaways:

- Multiple credit scoring models are available, but FICO® Scores and VantageScores are the most common.

- FICO® Scores are used in over 90% of lending decisions and are widely accepted.

- VantageScores are gaining popularity and were developed as an alternative to FICO Scores.

- Both FICO® Scores and VantageScores consider factors such as payment history, credit utilization, and length of credit history.

- The specific credit score that matters most depends on the lender and the type of credit being applied for.

Understanding Credit Scoring Models

When it comes to assessing creditworthiness, lenders rely on credit scoring models to make informed decisions. The two main credit scoring models used in the industry are FICO and VantageScore. These models take into account various factors, such as payment history and utilization rate, but they use different formulas to weigh these factors, resulting in different credit scores.

Table: Comparison of FICO and VantageScore Credit Scoring Models

| Scoring Factor | FICO | VantageScore |

|---|---|---|

| Payment History | Weighs heavily | Significant impact |

| Utilization Rate | Important factor | Weighed differently based on individual credit files |

| Length of Credit History | Considered | Factors in |

FICO is the most widely used credit scoring model and has been the industry standard for many years. It is used by over 90% of lenders, making it crucial to understand how it works. On the other hand, VantageScore is a newer model that is gaining popularity, especially among lenders who want a broader view of an applicant’s creditworthiness.

It’s important to note that different lenders may have preferences for certain credit scoring models based on their own evaluation processes. Additionally, specific types of loans may have industry-specific scores that cater to the unique dynamics of that loan category.

Understanding the specific credit scoring model used by each lender is essential when applying for credit. By being aware of the scoring factors employed in each model, borrowers can better understand the importance of maintaining a positive credit profile.

Factors Affecting Credit Scores

Credit scores are influenced by various factors that lenders use to assess an individual’s creditworthiness. To understand how credit scores are determined, it’s important to consider the following factors:

- Payment History: Timely payment of bills and debts is crucial for maintaining a good credit score. Late payments or defaults can significantly impact credit scores.

- Utilization Rate: The utilization rate refers to the percentage of available credit that an individual is using. It’s recommended to keep credit card balances low to maintain a healthy credit score.

- Length of Credit History: The length of time that accounts have been open and active contributes to credit scores. A longer credit history demonstrates responsible credit management.

- Credit Inquiries: When individuals apply for new credit, lenders may request their credit reports, resulting in hard inquiries. Multiple hard inquiries within a short period can lower credit scores temporarily.

- Credit Mix: Having a diverse mix of credit accounts, such as credit cards, loans, and mortgages, can positively impact credit scores. This shows the ability to manage different types of credit responsibly.

Among these factors, payment history and utilization rate carry the most significant weight in determining credit scores. Individuals should prioritize making timely payments and keeping credit balances low to improve or maintain a good credit score.

Importance of Factors in Credit Score Calculation

According to credit scoring models, payment history and utilization rate contribute to around 65-70% of an individual’s credit score. The length of credit history, credit mix, and credit inquiries make up the remaining portion of the score calculation.

It’s worth noting that credit scores can fluctuate based on changes in these factors over time. By understanding the importance of each factor, individuals can make informed decisions to positively impact their credit scores.

| Factor | Weight in Credit Score Calculation |

|---|---|

| Payment History | 35% |

| Utilization Rate | 30% |

| Length of Credit History | 15% |

| Credit Inquiries | 10% |

| Credit Mix | 10% |

By actively managing these credit score factors, individuals can work towards improving their creditworthiness and securing better financial opportunities.

Understanding Credit Bureaus

When it comes to calculating credit scores, credit bureaus play a vital role. These bureaus compile credit reports, which serve as the foundation for determining creditworthiness. The three major credit bureaus in the United States are Experian, Equifax, and TransUnion.

It’s important to note that not all lenders report to all three bureaus. As a result, each bureau may have slightly different information on your credit report. That’s why it’s essential to review your credit report from each bureau to ensure accuracy and identify any potential errors that might be impacting your credit scores.

“Credit bureaus compile credit reports, which are used to calculate credit scores, enabling lenders to assess an individual’s creditworthiness.”

Comparing Credit Bureau Information

Although Experian, Equifax, and TransUnion are all major credit bureaus, the information they provide can differ. Table 4.1 provides an overview of the key differences in their credit reporting data:

| Experian | Equifax | TransUnion | |

|---|---|---|---|

| 1. Credit Report Information | Provides details of an individual’s borrowing history and credit accounts. | Captures credit data from lenders and creditors. | Gathers credit information from various sources. |

| 2. Credit Score Calculation | Uses its own scoring model to calculate credit scores. | Employs the Equifax Credit Score model to determine credit scores. | Utilizes its own Credit Vision Scoring model to generate credit scores. |

| 3. Reporting Frequency | Updates credit reports monthly. | Updates credit reports every 30 days. | Updates credit reports as new information is received. |

Reviewing your credit report from each bureau gives you a comprehensive understanding of your credit profile and allows you to identify any discrepancies or errors. This enables you to promptly address them and ensure your creditworthiness is accurately reflected.

Importance of Monitoring Credit

Monitoring credit is a crucial aspect of managing your financial health. By regularly checking your credit report, you can gain a better understanding of your credit standing and identify any potential issues or errors that may be affecting your credit score. It allows you to stay on top of your credit profile and take appropriate actions to improve it, if necessary.

One of the key benefits of monitoring your credit is the ability to track changes in your credit score over time. Your credit score is a numerical representation of your creditworthiness, and it can fluctuate based on various factors such as payment history, credit utilization, and length of credit history. By keeping an eye on your score, you can easily identify any significant changes and take the necessary steps to address them.

Fortunately, checking your own credit does not negatively impact your credit score. In fact, it is encouraged for individuals to monitor their credit regularly to ensure accuracy and detect any potential signs of identity theft or fraudulent activity.

There are several tools available that enable you to monitor your credit report and track your credit score for free. One such tool is CreditWise from Capital One, which provides access to your credit score and alerts you to any changes or potential issues. Additionally, annualcreditreport.com allows you to obtain a free copy of your credit report from each of the three major credit bureaus – Experian, Equifax, and TransUnion – once every 12 months.

| Benefits of Monitoring Credit | Credit Monitoring Tools |

|---|---|

|

|

By actively monitoring your credit, you can take control of your financial well-being and make informed decisions about your credit usage. It empowers you to proactively manage your credit score and work towards achieving your financial goals.

Most Widely Used Credit Scores

When it comes to credit scores, one name stands out among the rest: FICO Scores. Used by over 90% of lenders, FICO Scores are the most widely accepted credit scores in the industry. These scores provide lenders with a snapshot of an individual’s creditworthiness and serve as an important factor in determining loan approvals and interest rates.

While FICO Scores dominate the lending landscape, it’s important to note that the specific credit score used may vary depending on the lender and the type of credit being applied for. Different lenders may have preferences for certain credit scoring models based on their own criteria and risk evaluation processes. Understanding which credit score a particular lender uses is crucial when applying for credit.

Another credit scoring model that has been gaining popularity in recent years is VantageScore. Developed jointly by the three major credit bureaus (Experian, Equifax, and TransUnion), VantageScore provides lenders with an alternative credit scoring model to assess creditworthiness.

Although FICO Scores and VantageScores use different algorithms to calculate credit scores, both consider similar factors such as payment history, credit utilization, length of credit, credit mix, and new credit applications. While the specific calculation methods may differ, the underlying goal of these credit scoring models remains the same: to gauge an individual’s creditworthiness.

Ultimately, understanding the credit scoring models that lenders prefer can give individuals insight into how their creditworthiness is evaluated. By maintaining healthy credit habits and keeping an eye on their credit scores, individuals can position themselves for better lending opportunities and financial success.

If you’re curious about the differences between FICO Scores and VantageScores, take a look at this table comparing the two:

| FICO Score | VantageScore | |

|---|---|---|

| Creator | Fair Isaac Corporation | Developed jointly by Experian, Equifax, and TransUnion |

| Range | 300-850 | 300-850 |

| Credit Scoring Model | Multiple versions available, including FICO Score 8 and FICO Score 9 | VantageScore 3.0 and VantageScore 4.0 |

| Factors Considered | Payment history, credit utilization, length of credit history, credit mix, new credit applications | Similar factors to FICO Score |

| Lender Preferences | Used by over 90% of lenders | Gaining popularity among lenders |

| Industry-specific Scores | FICO Auto Scores, FICO Score for credit cards, FICO Mortgage Scores | N/A |

Understanding the nuances and differences between FICO Scores and VantageScores can help individuals navigate the credit landscape more effectively. By staying informed and focusing on maintaining good credit habits, individuals can improve their creditworthiness and open doors to better lending opportunities.

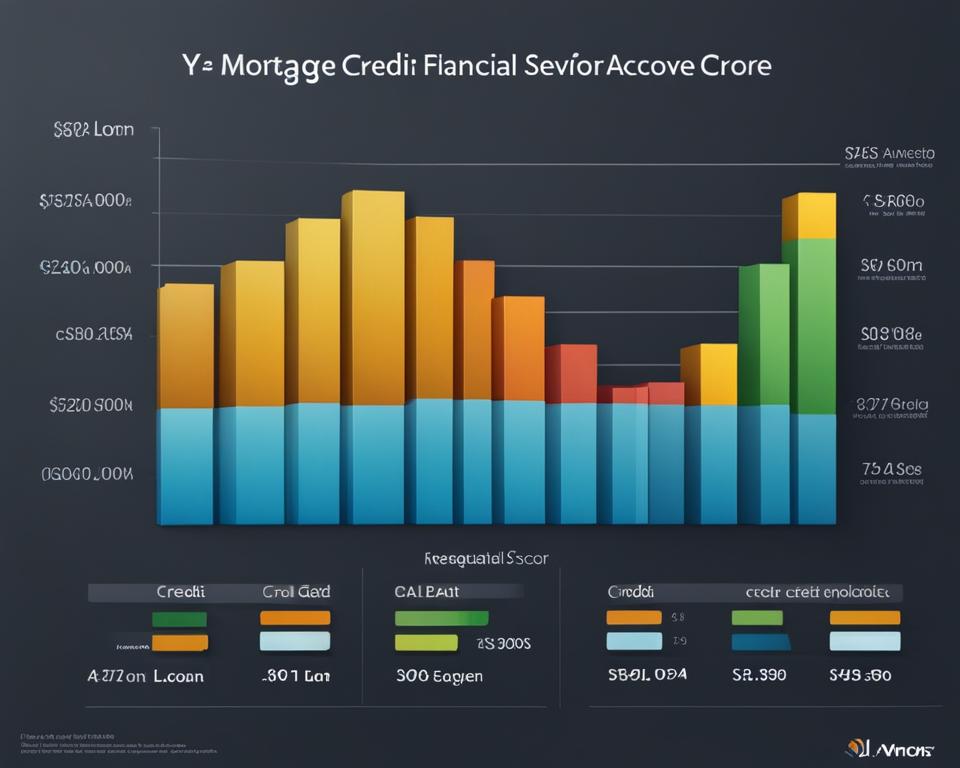

Credit Scores for Different Financial Products

When it comes to evaluating creditworthiness for different financial products, such as loans, credit cards, mortgages, and auto loans, different credit scores may be used by lenders. It’s important to understand the specific credit score version that is relevant for the type of credit you are applying for in order to assess your chances of approval.

For example, when applying for an auto loan, lenders often use FICO Auto Scores to make their decisions. These scores are specifically designed to assess a borrower’s creditworthiness for auto financing. On the other hand, mortgage applications typically rely on specific versions of FICO Scores that are tailored to the unique requirements of the mortgage industry.

For credit card applications, base scores like FICO Score 8 are commonly used. These scores provide an overall assessment of a borrower’s creditworthiness, taking into account factors such as payment history, credit utilization, length of credit history, and more.

Understanding which credit score is relevant for a particular financial product can give you valuable insights into your chances of approval. It allows you to gauge how lenders may perceive your creditworthiness based on their specific criteria and risk evaluation processes.

To navigate the credit landscape effectively, take the time to check the specific credit score version used for the type of credit you are applying for, and focus on improving your credit health accordingly. By maintaining a good credit score and demonstrating responsible credit management habits, you can increase your chances of securing the financial products you need.

Different Credit Scores for Financial Products

| Financial Product | Relevant Credit Score |

|---|---|

| Auto Loans | FICO Auto Scores |

| Mortgages | Specific versions of FICO Scores |

| Credit Cards | Base scores like FICO Score 8 |

How to Improve Your Credit Score

Improving your credit score involves developing good credit management habits. By paying attention to key factors that impact your credit score, you can take steps towards enhancing your financial health and gaining access to better lending opportunities.

Maintain a Positive Payment History

One of the most crucial aspects of credit management is maintaining a positive payment history. Make it a priority to pay your bills on time, every time. Late or missed payments can significantly impact your credit score and could lead to higher interest rates on future loans or credit cards.

Manage Credit Utilization

Credit utilization refers to the amount of credit you are utilizing compared to your total available credit limit. It’s recommended to keep your credit utilization below 30% to maintain a healthy credit score. Paying down debts and keeping credit card balances low can positively impact your utilization rate.

Demonstrate a Length of Credit

The length of your credit history plays a role in determining your credit score. Keeping old credit accounts open, even if they have a zero balance, can contribute to a longer credit history and ultimately enhance your credit score.

Diversify Your Credit Mix

Having a mix of different types of credit accounts, such as credit cards, loans, and a mortgage, can demonstrate responsible credit management. However, it’s essential to only take on credit that you can comfortably manage and make timely payments on.

Avoid Excessive New Credit Applications

Opening multiple new credit accounts within a short period can raise red flags for lenders and impact your credit score. Each new credit application triggers a hard inquiry, which temporarily reduces your credit score. It’s best to only apply for credit when necessary and be mindful of the potential impact on your score.

“Improving your credit score is a gradual process that requires consistent effort in managing your credit responsibly. By following these tips and adopting healthy credit management habits, you can set yourself up for financial success and achieve a better credit score over time.”

Scoring Variations and Timing

In the world of credit scores, variations can occur due to several factors, including the credit scoring model used, timing of the score calculation, and updates to credit reports. These factors can contribute to discrepancies in the credit scores obtained at different points in time.

Let’s explore each of these factors:

1. Credit Scoring Model:

Credit scoring models, such as FICO and VantageScore, utilize different algorithms to evaluate a borrower’s creditworthiness. These scoring models weigh various factors differently, resulting in variations in credit scores. Lenders may have their preferred scoring model, so it’s essential to understand which model is being used when applying for credit.

2. Timing of Credit Score Calculation:

The timing of credit score calculations can also influence the variations in credit scores. Credit scores are not stagnant and can change over time. They are calculated based on the information available at the moment of assessment. Therefore, credit scores obtained on different dates may reflect different financial behaviors and credit report updates.

3. Updates to Credit Reports:

Credit scores rely on the data provided by credit bureaus, such as Experian, Equifax, and TransUnion. These bureaus receive information from lenders and creditors, which they update in credit reports. If there are updates or changes to credit reports, such as the addition of new credit accounts or the update of payment information, it can impact the credit scores calculated based on that data.

It’s important to consider these factors when comparing credit scores at different times. Without a doubt, the credit scores you obtain today may differ from those obtained in the past or the future due to credit score variations, timing of credit score calculation, and credit report updates.

Understanding the dynamics of credit scoring variations and timing can help individuals make informed decisions when reviewing their credit scores and taking steps to improve their credit health.

The Role of Credit Bureaus and Scoring Companies

In the world of credit scoring, credit bureaus and scoring companies play a vital role in evaluating individuals’ creditworthiness. Credit bureaus, such as Equifax, Experian, and TransUnion, collect and store credit information from lenders and creditors. This data serves as the foundation for credit reports, which contain detailed information about an individual’s credit history, accounts, and payment behavior.

Credit scoring companies, such as FICO and VantageScore, utilize the data provided by credit bureaus to calculate credit scores using their own proprietary scoring models. These scores help lenders assess the risk associated with lending money to a particular individual.

When requested by lenders or individuals, credit bureaus provide credit scores as a reflection of an individual’s creditworthiness. These scores aid lenders in making informed decisions about loan approvals, interest rates, and credit limits. Additionally, individuals can also access their credit scores to understand their own financial standing and take steps towards improving their credit health.

Understanding the role of credit bureaus and scoring companies is essential in navigating the world of credit and making informed financial decisions. By maintaining good credit habits and staying knowledgeable about credit scoring practices, individuals can enhance their chances of securing favorable lending terms and achieving their financial goals.

Understanding Credit Score Accuracy

When it comes to credit scores, accuracy is crucial. These scores are calculated based on the information provided by credit bureaus in credit reports. Two popular credit scoring companies, FICO and VantageScore, use different scoring models to calculate credit scores. While scores may vary slightly between these models, it’s important to focus on the factors that impact scores rather than comparing scores for accuracy.

One key aspect of credit score accuracy is the information contained in credit reports. Lenders rely on these reports to assess an individual’s creditworthiness. Inaccurate or outdated information can lead to flawed credit scores. It’s important for individuals to regularly review their credit reports from bureaus like Experian, Equifax, and TransUnion to ensure accuracy and identify any errors that may be negatively impacting their credit scores.

Table: Comparison of FICO and VantageScore

| Scoring Model | Calculation Method | Industry Acceptance |

|---|---|---|

| FICO | Uses specific algorithms for different types of credit | Over 90% of lenders rely on FICO scores for lending decisions |

| VantageScore | Considers similar factors but weighs them differently | Gaining popularity among lenders |

While credit scores are important, it’s essential to focus on the factors that influence these scores rather than getting caught up in small variations between models. Payment history, credit utilization, length of credit history, credit mix, and new credit applications are key factors to consider. By managing these factors responsibly, individuals can work towards improving their credit scores over time.

Factors Influencing Credit Scores

Credit scores are influenced by various factors that lenders consider when assessing an individual’s creditworthiness. Understanding these factors can help individuals make informed decisions and take steps to improve their credit health.

Payment History

A person’s payment history is one of the most important factors that impacts their credit score. Lenders want to see a track record of on-time payments and responsible financial behavior. Late or missed payments can have a significant negative impact on a credit score.

Credit Utilization

Credit utilization, also known as the amount of credit used compared to the total credit available, is another crucial factor. Maintaining a low credit utilization ratio, ideally below 30%, demonstrates responsible credit management and can positively affect a credit score.

Credit Mix

The types of credit accounts a person has also play a role in determining their credit score. A diverse credit mix, including a combination of credit cards, loans, and mortgages, can indicate good financial management skills and may positively impact a credit score.

New Credit Applications

Opening multiple new credit accounts within a short period can raise concerns for lenders. Every time someone applies for credit, it generates a hard inquiry on their credit report, which can temporarily lower their credit score. It’s important to be mindful of the number of credit applications made.

Remember, maintaining a good credit score requires a consistent effort to manage these credit score factors responsibly.

In summary, payment history, credit utilization, credit mix, and new credit applications are primary factors that influence credit scores. By paying bills on time, keeping credit card balances low, diversifying credit types, and being cautious about new credit applications, individuals can improve their credit scores and enhance their financial well-being.

| Factors | Influence on Credit Scores |

|---|---|

| Payment History | High impact |

| Credit Utilization | High impact |

| Credit Mix | Moderate impact |

| New Credit Applications | Moderate impact |

Understanding these credit score factors empowers individuals to make sound financial decisions and work towards achieving a strong credit profile.

The Importance of Credit Monitoring

Monitoring credit is crucial for maintaining the accuracy of credit reports and detecting any errors or inaccuracies that may impact credit scores. By regularly monitoring their credit, individuals can take timely action to address incorrect information and maintain or improve their credit standing. Credit monitoring services and free credit reports provide valuable tools for individuals to track changes in their credit profiles and ensure the integrity of their credit information.

The Benefits of Credit Monitoring

Credit monitoring offers several key advantages for individuals:

- Ensuring Credit Report Accuracy: Regularly monitoring credit allows individuals to verify the accuracy of their credit reports. By reviewing their credit information, they can identify any discrepancies or errors that might affect their credit scores. Detecting and addressing these inaccuracies is crucial for maintaining a fair and accurate representation of one’s credit history.

- Identifying and Resolving Errors: Monitoring credit enables individuals to promptly identify any errors or discrepancies in their credit reports. Inaccurate information can negatively impact credit scores and hinder access to financial opportunities. By spotting incorrect data early, individuals can take steps to rectify the errors and mitigate the potential impact on their credit profiles.

- Protecting Against Identity Theft: Credit monitoring can help individuals detect any suspicious activity that may indicate identity theft. By monitoring their credit reports for unfamiliar accounts or unauthorized inquiries, individuals can identify potential fraudulent activity and take immediate action to safeguard their financial well-being.

- Tracking Credit Score Changes: Monitoring credit allows individuals to stay informed about changes in their credit scores over time. By monitoring these changes, individuals can gain insights into their creditworthiness and take proactive steps to improve their credit scores if needed.

The Role of Credit Monitoring Services

Credit monitoring services play a vital role in helping individuals keep a close eye on their credit profiles. These services offer features such as:

- Regular credit report updates

- Alerts for significant changes in credit reports

- Monitoring for potential signs of identity theft

- Assistance with disputing any inaccuracies or errors

Utilizing credit monitoring services empowers individuals to proactively manage their credit health and take action to protect themselves from potential credit-related challenges.

By embracing credit monitoring as a proactive financial tool, individuals can ensure the accuracy of their credit reports, detect any errors or inconsistencies, and maintain or improve their credit standing. With the availability of credit monitoring services and free credit reports, staying informed about one’s credit profile has never been easier or more important.

The Role of Credit Scores in Lending Decisions

Credit scores are a critical factor in lending decisions as they are used by lenders to determine the creditworthiness of borrowers. A credit score provides an overview of an individual’s credit history and serves as an indicator of their ability to manage and repay debts. Lenders rely on credit scores to make well-informed decisions regarding loan approvals, interest rates, and loan amounts.

A higher credit score indicates a lower risk of default, which can result in more favorable loan terms, including lower interest rates and higher borrowing limits. On the other hand, a lower credit score may lead to higher interest rates or even loan denial.

Lenders assess creditworthiness by looking at the credit scores provided by credit bureaus, such as Experian, Equifax, and TransUnion. These scores are based on factors such as payment history, credit utilization, length of credit history, credit mix, and new credit applications.

By evaluating these factors, lenders gain insight into an individual’s financial responsibility and ability to repay their debts. This assessment allows lenders to determine the level of risk associated with lending to a particular individual.

The use of credit scores provides lenders with an efficient and standardized method for assessing creditworthiness. It allows them to evaluate borrowers consistently and objectively, taking into account various financial factors that impact their ability to fulfill their financial obligations.

Credit Scores for Different Loan Types

Different types of financial products may require specific credit scores for loan approval. For example, mortgage lenders often use versions of the FICO Score tailored to the mortgage industry, such as FICO Score 2, 4, or 5. Auto lenders may use FICO Auto Scores, while credit card issuers commonly use FICO Bankcard Scores or FICO Score 8.

The specific credit score required may vary depending on the lender and the type of loan being applied for. It’s essential for borrowers to be aware of the credit score requirements for their desired loan type to assess their eligibility and improve their chances of approval.

| Loan Type | Credit Score Requirement |

|---|---|

| Mortgage | FICO Score 2, 4, or 5 |

| Auto Loan | FICO Auto Score |

| Credit Card | FICO Bankcard Score or FICO Score 8 |

It’s important for individuals to monitor their credit scores regularly and take steps to improve them if necessary. This includes making timely payments, minimizing credit card balances, and maintaining a good mix of credit accounts. By actively managing their credit, borrowers can increase their chances of loan approval and secure more favorable lending terms.

Conclusion

Understanding credit scores, comparing them, and striving to improve your credit health is vital for financial well-being. With various credit scoring models in use, FICO Scores stand as the most widely accepted measure of creditworthiness. However, regardless of the scoring model, responsible credit management is key to achieving better lending opportunities.

By monitoring your credit scores and implementing good credit habits, such as making timely payments and maintaining a low credit utilization ratio, you can enhance your creditworthiness over time. These actions pave the way for improved lending terms, allowing you to access the financial resources you need while saving money on interest rates.

Remember, understanding the factors that influence credit scores, including payment history, credit utilization, and credit mix, empowers you to make informed decisions about your credit health. Regularly checking your credit report for accuracy and disputing any errors is also essential to ensure your credit profile is a true reflection of your financial responsibility.

By taking control of your credit health and following sound credit management practices, you can pave the way for a brighter financial future. Empower yourself with the knowledge and tools necessary to make informed decisions and enjoy the benefits of improved credit health.

FAQ

Which credit score matters most?

The specific credit score that matters most depends on the reason for checking and the type of loan or credit being applied for.

What are the main credit scoring models used by lenders?

The two main credit scoring models used by lenders are FICO and VantageScore.

What factors affect credit scores?

Factors that can affect credit scores include payment history, utilization rate, length of credit history, credit inquiries, and credit mix.

What are credit bureaus?

Credit bureaus are companies that collect and store credit information from lenders and creditors, which serves as the basis for credit reports and credit scores.

Why is monitoring credit important?

Monitoring credit is important to ensure the accuracy of credit reports, detect errors, and track changes in credit scores.

What are the most widely used credit scores?

The most widely used credit scores are FICO Scores, although the specific credit score used may vary depending on the lender and the type of credit being applied for.

Do different financial products use different credit scores?

Yes, different types of financial products may use different credit scores to evaluate creditworthiness.

How can I improve my credit score?

Improving your credit score involves developing good credit management habits, such as making timely payments and keeping credit card balances low.

Can credit scores vary?

Yes, credit scores can vary based on factors such as the credit scoring model used, timing of the score calculation, and updates to credit reports.

What is the role of credit bureaus and scoring companies?

Credit bureaus collect and store credit information, while scoring companies like FICO and VantageScore use this data to calculate credit scores.

How accurate are credit scores?

The accuracy of credit scores depends on the accuracy of the information in credit reports, although slight variations in scores may occur.

What factors influence credit scores?

Factors that influence credit scores include payment history, credit utilization, credit mix, and new credit applications.

Why is credit monitoring important?

Credit monitoring is important to ensure the accuracy of credit reports and detect errors or inaccuracies that may be impacting credit scores.

How do credit scores impact lending decisions?

Credit scores play a crucial role in lending decisions, as they are used by lenders to assess the creditworthiness of borrowers.

How can I understand credit scores better?

Understanding credit scores involves knowing the different scoring models, factors that influence scores, and how to improve credit health.