In the quest for financial freedom, debt management emerges as a pivotal cornerstone, anchoring the stability of personal economies across the United States. In an era where loans and credit are as ubiquitous as they are necessary, the art of financial planning has shifted from mere suggestion to absolute necessity. A strategic approach to managing one’s financial obligations, including the development of a comprehensive debt repayment plan, can provide both immediate relief and long-term safeguarding against economic turbulence.

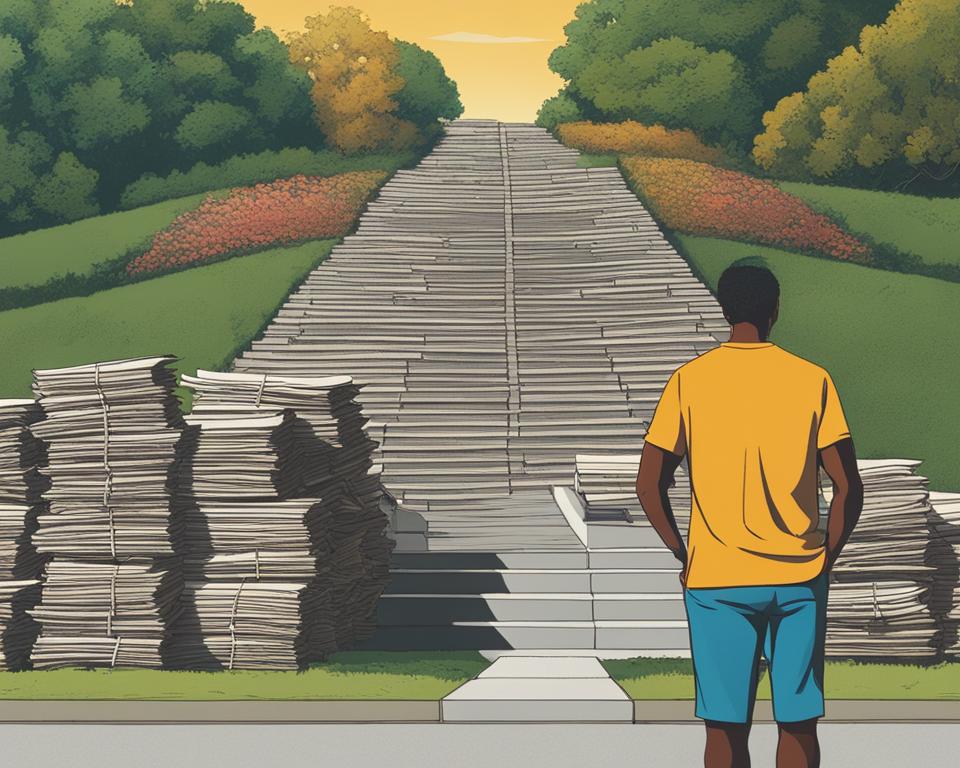

With thoughtful planning and execution, individuals can transform their approach to debt from one of dread to one of empowerment. Understanding the tools at one’s disposal, such as tailor-made debt relief options and tactical repayment strategies, can flatten the mountain of financial burden into manageable hills, ready to be conquered with consistency and informed decision-making.

Key Takeaways:

- Applying deliberate debt management techniques stabilizes one’s financial position and prevents debt from escalating.

- Establishing a debt repayment plan is critical for methodical reduction of debt over time.

- Proactive financial planning and assessment are essential for identifying the most effective debt relief channels.

- Preventing financial strife through careful debt control affords peace of mind and promotes economic resilience.

- Engagement in smart financial behaviors further enables individuals to navigate through loans and credit with confidence and agility.

Understanding the Importance of Debt Management

Mastering the intricacies of debt management is a linchpin in safeguarding one’s financial health. Far from being merely about keeping track of various debts, it is an exercise in maintaining discipline with finances to guarantee peace of mind and secure one’s future borrowing ability. Smart management of debt influences a broad spectrum of financial facets, from credit score improvement to the cultivation of borrowing strategies that ensure flexibility and financial freedom.

The Consequences of Poor Debt Control

The ripple effects of mismanaging debt can be severe, impacting far beyond the immediate stress of unpaid bills. Neglected debt management adversely affects one’s credit score, a vital indicator of financial reliability that lenders scrutinize. A bruised score can prove costly, not only in terms of elevated interest rates but also in one’s capacity to acquire essential funding for major life events such as purchasing a home or funding education.

Additional ramifications include a cascade of late fees and heightened interest charges, compounding the initial sums owed exponentially. This can set off a vicious cycle wherein individuals become ensnared in a mire of debt obligations, struggling to break free.

Good Debt Management and Opportunities

Conversely, astute debt management can illuminate a path to substantial savings and fiscal opportunities. With a robust and thoughtful approach to handling obligations, opportunities begin to unfold in the form of lower interest rates on loans and increased chances of approval for borrowing endeavors. Consistently responsible financial behavior signals to lenders that one is a low-risk investment, often resulting in favorable loan terms.

One tangible byproduct of disciplined debt management is the improvement of one’s credit score. This three-digit number is a potent factor in financial maneuverability, and a higher score can open the door to an array of advantages, including better interest rates, which can translate into vast monetary savings over a loan’s lifetime.

It’s important to note that debt management involves both short-term sacrifices and long-term strategies. Sacrifices such as curbing spending and prioritizing debt repayment lay the groundwork for a debt-free future. Long-term strategies, such as establishing a solid emergency fund and consistent contributions to retirement accounts, ensure that one’s financial journey is neither disrupted by unforeseen expenses nor derailed by later-life fiscal insecurity.

Below is a table illustrating some core differences between poor and good debt management and their respective impact on an individual’s financial prospects:

| Aspect of Debt Management | Impact of Poor Management | Impact of Good Management |

|---|---|---|

| Credit Score | Potential decrease due to missed payments and high credit utilization | Improvement through consistent on-time payments and managed credit balances |

| Future Borrowing Capacity | Could face rejects or high-interest rates on loans and credit | Access to better terms and increased likelihood of loan approval |

| Financial Stress Levels | High with growing debts and accumulating interests | Lower stress with a manageable debt load and a clear payoff plan |

Ultimately, debt management is not only about navigating present financial waters but also charting a course for future fiscal milestones. The ability to balance debts, savings, and investments is foundational to long-term financial success and contentment.

Strategies for Timely Bill Payments

Effective management of bill payments is not just about keeping track of amounts due; it’s about establishing a system that guarantees punctuality and reliability—two pillars upon which financial stability is built. To avoid the stress and financial strain of late fees that contribute to growing debt, consider incorporating the following strategies into your financial routine for timely bill payments and solid debt help.

- Automated Payment Systems: Enroll in automatic payments to ensure bills are paid on time without the need for manual intervention each month.

- Calendar Alerts: Set digital reminders a few days before your bills are due as a safety net to automated systems or for bills that require manual payment.

- Consolidated Payment Dates: Many service providers allow you to change your payment due date. Aligning all your bills to a specific time of the month can simplify your payment schedule.

- Online Banking Tools: Use your bank’s online platform to schedule payments well in advance, ensuring you’ll never miss a due date.

- Budget Adjustments: Adjust your monthly budget to prioritize bill payments, ensuring that you always have enough funds allocated for this essential financial obligation.

- Payment Plan Negotiations: If you’re struggling to make timely payments, reach out to your creditors to negotiate a payment plan that suits your financial capacity.

By embedding these habits into your financial practices, you’re not just ensuring that bills are paid; you’re paving the way toward debt solutions that last. The result can be a more positive credit history, less stress about finances, and an overall sense of debt help and control.

| Strategy | Benefits | Considerations |

|---|---|---|

| Automatic Payments | Ensures on-time payments, less hassle | Must ensure account has sufficient funds |

| Calendar Alerts | Act as a backup, offers personal control | Relies on individual to make the payment |

| Consolidated Dates | Streamlines payment process | May need negotiation with creditors |

| Online Banking | Convenient and quick | Requires internet access |

| Budget Adjustments | Prevents overspending, prioritizes obligations | May limit discretionary spending |

| Payment Plan | Can alleviate financial burden | May extend the debt period |

Remember, while these strategies are crucial for maintaining financial stability, always seek professional debt help if payments become unmanageable. Debt solutions are best tailored to individual circumstances, and timely bill payments are just one piece of the puzzle to achieving long-term financial health.

Prioritizing and Tackling High-Interest Debt

When faced with various forms of debt, it’s critical for individuals to adopt savvy financial planning practices that target high-interest debt effectively. This aggressive approach can lead to more efficient debt management and long-term monetary gains. Initiating this strategy begins with understanding how different debts impact your financial well-being and identifying which to address first.

Employing the Avalanche Method

The Avalanche method is a preferred debt solution for many financial advisors due to its efficiency in handling debts with high accrual rates. By prioritizing these menacing debts, individuals can reduce the total interest paid over time, liberating themselves from the clutches of compounding interest more swiftly.

Here are the key steps to utilizing the Avalanche Method:

- Analyze all outstanding debts and organize them by interest rates, pinpointing those with the highest rates.

- Allocate as much money as possible to pay down the most expensive debt—meaning, the one with the highest interest rate—while maintaining minimum payments on all other obligations.

- Once the highest interest debt is fully paid off, redirect the focus and highest payments to the debt with the next highest interest rate, and so on.

- Repeat this process until all debts have been paid off.

This structured approach not only requires disciplined financial planning but also a consistent dedication to the debt management journey. As high-interest debts decrease, the money once spent on those costly interest payments can be rerouted to build a solid financial foundation, offering debt solutions that many strive for.

Remember, the goal of managing debt isn’t simply to keep up with payments, but to outpace them and emerge from under the shadow of debt faster and more effectively. With the right financial planning strategies in place, such as the Avalanche method, managing and overcoming high-interest debt becomes an attainable objective that leads to financial freedom.

The Necessity of Making Minimum Payments

For individuals juggling financial obligations, understanding the role of minimum payments is vital in maintaining a healthy credit score and ensuring effective debt management. Ensuring that these minimal amounts are met each month can prevent a plethora of financial drawbacks.

Meeting or exceeding minimum payments on time each month is not just about fulfilling contractual obligations—it’s also about safeguarding one’s financial reputation and avoiding further debt accumulation through additional fees and penalties. See below for a breakdown of why making at least the minimum payment is crucial for your finances:

| Benefits of Making Minimum Payments | Consequences of Missing Minimum Payments |

|---|---|

| Keeps account in good standing | Account can fall into delinquency |

| Avoids late fees and penalty charges | Accrues late fees and increases cost of debt |

| Maintains credit score stability | Credit score suffers and reduces borrowing power |

| Prevents increased interest rates | Potential for interest rate hikes on current and future debts |

| Builds positive credit history over time | Negative marks on credit report impacting future financial opportunities |

While making the minimum payment is essential, it is equally important to strive towards paying more than the minimum in order to reduce the principal amount of debt faster. This approach can save significant amounts in interest over the life of the debt and shorten the timeline to financial freedom. Still, if budget constraints limit the ability to pay extra, ensuring the minimum payment should always be a top priority to keep financial health intact.

- Always check account statements for the minimum payment amount.

- Set reminders or automate payments to avoid missing deadlines.

- Review the budget for any adjustments that can increase payment amounts.

Even small additional payments above the minimum can compound over time, leading to noticeable progress in debt reduction. Effective financial planning with a focus on responsible debt management is the backbone of a stable economic future.

Conducting a Comprehensive Debt Assessment

To navigate the complexities of debt management, initiating a meticulous assessment of your financial obligations is crucial. This comprehensive review not merely enlightens you about your current fiscal position but also actuates the groundwork for developing a potent debt relief strategy. An all-encompassing analysis will encompass each fragment of your debt, including credit card balances, loans, and other monetary responsibilities.

Creating a Clear Financial Obligations Inventory

Gleaning a lucid snapshot of your cumulative liabilities is the first maneuver in prepping for adept debt management. Brevity is not an ally when charting the expanse of your debts. Instead, elaboration begets clarity—each credit card, line of credit, and loan must be accounted for with minutiae. Interest rates, balances, minimum payments, and due dates—these are the categories that, when tallied, furnish the frame for your debt portrait, informing your strategies for repayment prioritization.

Embarking on this debt expedition demands organization. A tabulation of the requisite information not only aids in visualizing your indebted stance but also ensures no strand of debt remains overlooked. Below is a conjectural illustration of such an inventory:

| Creditor | Account Type | Balance ($) | Interest Rate (%) | Minimum Payment ($) | Due Date |

|---|---|---|---|---|---|

| BankCard A | Credit Card | 5,200 | 19.99 | 104 | April 15 |

| LoanCo B | Student Loan | 15,000 | 6.80 | 150 | May 1 |

| Mortgage Services C | Mortgage | 250,000 | 4.25 | 1,230 | April 30 |

To further this endeavor, achieving debt relief calls for incessant vigilance and dedication to keep your ledger current. As interest rates fluctuate, and balances dwindle or rise, recurrent revisitation of your inventory is critical. A static snapshot may suffice to ignite the process, but dynamic, reiterative review secures success in the long-term debt management parade.

Ultimately, effectual debt management is a continual process. It demands acute attention to not only the dollars and cents you owe but to the context in which you owe them—interest rates, due dates, and financial obligations. A robust, transparent inventory is your ally, providing clarity in the murky waters of debt and a beacon towards the shores of fiscal stability and relief.

Establishing an Emergency Fund

When it comes to financial planning, one of the most critical steps is creating an emergency fund. An emergency fund provides a cushion for unexpected expenses, such as medical bills, urgent home repairs, or sudden job loss. By allocating funds for unforeseen circumstances, individuals can avoid the stress of finding debt help to cope with emergencies.

Considering how crucial an emergency fund is, it’s recommended to save an amount approximately equal to three to six months’ worth of living expenses. This can serve as a significant defense against life’s unpredictable moments and financial setbacks. To illustrate why an emergency fund should be a non-negotiable aspect of your budget, consider the following advantages:

- It helps maintain financial stability in the event of sudden income disruption.

- Reduces the need to rely on high-interest credit cards or loans during a crisis.

- Provides peace of mind, knowing that you are prepared for unforeseen costs.

- Ensures that progress on long-term financial goals is not derailed by surprise expenses.

Building an emergency fund may feel daunting, but with consistent efforts, even small contributions can add up over time. Here’s a table that demonstrates potential monthly savings strategies to help you establish this all-important financial buffer:

| Monthly Savings Goal | 3-Month Fund Total | 6-Month Fund Total | Time to Reach Goal |

|---|---|---|---|

| $500 | $1,500 | $3,000 | 6 months/1 year |

| $750 | $2,250 | $4,500 | 4 months/8 months |

| $1,000 | $3,000 | $6,000 | 3 months/6 months |

To help visualize the importance and impact of an emergency fund, consider the middle-of-the-road scenario wherein a monthly contribution of $750 can grow a solid emergency fund in less than a year.

Remember, the goal of an emergency fund is not only to cover expenses but also to prevent the downward spiral into problematic debt. The reassurance of having an emergency fund can be the crucial difference between financial security and precarious debt during times of crisis.

Debt Repayment Above Minimum Requirements

When confronting the challenge of debt repayment, a crucial step in financial planning lies in the willingness to go beyond the bare minimum. It’s not just about staying current with your obligations but strategically accelerating the repayment process. By paying extra on your debts, you make a powerful move towards diminishing the principal and saving on future interest.

Moreover, credit counseling experts assert that taking control of your debt in this manner not only improves your credit standing but also strengthens your overall financial resilience. This approach to debt help may require some sacrifices in the present but promises a more secure and flexible financial future.

To visualize the impact of paying more than the minimum, consider this comparison:

| Payment Strategy | Time to Payoff | Interest Paid | Principal Paid Early |

|---|---|---|---|

| Only Minimum Payments | 10 years | $3,000 | 0 |

| Extra $50/Month | 5 years | $1,500 | $2,500 |

| Extra $100/Month | 4 years | $1,200 | $5,000 |

As you can see, even a modest increase in your monthly payment can result in significant gains in the long haul, not just in reduced interest but in the time it takes to become debt-free.

Remember, customizing your debt repayment plan is about understanding your financial threshold. It’s about making informed and practical choices that align with sound financial planning, and often, seeking debt help from knowledgeable professionals in credit counseling is a smart move. Such proactive measures can place you firmly on the path to financial liberty.

Rebuilding Credit Post-Debt Issues

Embarking on the journey to rebuild credit following financial turbulence is a testament to resilience and commitment to financial health. With the right approach to debt consolidation and credit management, individuals can steadily improve their credit scores and regain financial stability.

Effective Tactics for Credit Score Recovery

Consistency in making payments on time builds a foundation of trust with creditors, and is the cornerstone of a robust credit recovery strategy. It demonstrates to potential lenders that one has the discipline and means to meet financial obligations. Additionally, engaging in debt consolidation options can simplify multiple debts into a single payment, potentially lowering the cost of borrowing and alleviating the complexity of tracking various accounts.

Importance of Credit Utilization and Diversity

Carefully managing credit utilization, which is the ratio of your outstanding credit card balances to your credit limits, can have a positive effect on one’s credit score. Keeping this ratio below 30% signals to creditors that you are not overextending yourself. Moreover, a diverse mix of credit accounts—including retail accounts, credit cards, installment loans, and mortgage loans—conveys responsible credit management, reflecting positively on credit histories.

A strategic approach to financial planning that includes these practices not only helps to rebuild credit but also shapes a financially stable future. It’s never too late to start, and every step taken is a move towards regaining financial freedom.

Utilizing a HELOC for Better Debt Consolidation

Exploring debt consolidation strategies, many households have discovered that a Home Equity Line of Credit, commonly referred to as a HELOC, can serve as a potent financial tool. With the ability to offer lower interest rates compared to other types of borrowing, a HELOC leverages the equity built up in a home, transforming it into accessible capital for paying down higher-interest debts. This strategic move can lead to more streamlined monthly finances, and when incorporated into comprehensive financial planning, it stands out as a sagacious approach to managing one’s fiscal affairs.

One of the key benefits of utilizing a HELOC for debt consolidation is the potential to significantly reduce the amount paid in interest over time. Unlike credit card debts that often come with higher rates, a HELOC’s revolving credit facility allows debtors to borrow at rates that are generally much closer to primary lending rates. Moreover, as part of a deliberate financial planning process, it ensures that funds are used optimally to target high-cost debts first.

Responsible use of a HELOC can transform an individual’s debt landscape, granting them the power to retake control of their financial future with more favourable repayment terms.

However, as with any financial product, acquiring a HELOC must be approached with diligence and the knowledge of how it interacts with personal finances. It’s imperative that individuals understand the terms and the repayment structure, which typically involves variable interest rates that can change over time. Seeking professional consultation to tailor the HELOC to personal debt repayment schedules, and to align it with longer-term financial goals, ensures that borrowers do not inadvertently exacerbate their fiscal status.

- Evaluation of current debt interest rates versus potential HELOC rates

- Assessment of the home equity available for borrowing

- Understanding of the repayment terms and any applicable fees

- Integration into an overarching personal financial plan

In conclusion, while a HELOC can provide a viable path to consolidate debt under lower interest rates, it requires a balanced approach that respects the risks and benefits. Aligning this option within the scope of established financial objectives is essential to navigate towards a sound fiscal standing, offering both immediate and long-term benefits when managed appropriately.

Monitoring Expenses via Personal Checking Accounts

With the ever-evolving nature of personal finance, personal checking accounts stand as a cornerstone in maintaining a healthy budget. These accounts offer a multitude of features that not only streamline the daily rigmarole of fiscal activities but empower consumers with the capacity to oversee their financial planning with precision.

Budgeting tools integrated into checking accounts can be a gamechanger for those grappling with debt management. The real-time tracking and alert systems convert the traditional account into a dynamic platform for monitoring cash flow and spending.

Maximizing the Benefits of Budget Tracking Tools

Intuitive budgeting features offer not just a snapshot but an ongoing narrative of one’s financial journey. Whether it’s categorizing transactions or setting personalized alerts for certain spending thresholds, these tools add a layer of accountability that’s indispensable in today’s fast-paced economic environment.

Maintaining Fiscally Responsible Habits

By diligently tracking expenses and employing budgeting aids provided by personal checking accounts, individuals foster fiscally responsible habits. Active engagement with these accounts facilitates pinpointing areas where spending can be curtailed, channelling more resources towards debt repayment and savings. It’s about adopting a vigilant approach to financial health, one transaction at a time.

| Feature | Benefit | Impact on Debt Management |

|---|---|---|

| Real-Time Alerts | Stay informed about account balances and potential overdrafts. | Prevents additional debt incurred from overdraft fees and bad spending decisions. |

| Spending Categorization | Easily track different types of expenses. | Identify overspending trends and make informed adjustments. |

| Automatic Bill Pay | Ensure bills are paid on time without manual input. | Mitigates risk of late fees and adverse effects on credit score. |

| Mobile Banking | Manage finances on-the-go to make timely financial decisions. | Enables immediate transfer of funds to service debts and avoid interest accrual. |

Exploring FNCB Bank’s Financial Management Tools

For those seeking to enhance their debt management capabilities, FNCB Bank provides an assortment of financial management tools. Personal checking accounts, for instance, are a cornerstone product designed to foster meticulous financial oversight and streamline daily monetary transactions. Integrating such tools into your financial strategy can be profoundly impactful in achieving your debt management goals.

Understanding the features of FNCB Bank’s personal checking accounts is imperative for those looking to gain control over their finances. These accounts come equipped with user-friendly budgeting functionalities, enabling customers to monitor spending patterns and make informed financial decisions promptly.

- Transaction Tracking

- Automated Alerts for Account Activities

- Versatile Mobile Banking Services

- Customizable Budgeting Tools

| Feature | Benefit |

|---|---|

| Online Bill Pay | Manages recurring expenses and ensures timely payments |

| Expense Categorization | Tracks spending habits and identifies areas for cost-saving |

| Mobile Deposit | Convenient check deposits anytime, anywhere |

| Zero Liability Protection | Security against unauthorized account transactions |

In the realm of debt management, FNCB Bank’s tools are indispensable. They provide customers with a clear, real-time picture of their financial health, promoting smarter spending and saving habits. This proactive approach to managing personal finances is essential in maintaining financial stability and working towards debt freedom.

With FNCB Bank’s financial management tools, taking charge of your financial future is not only possible but also convenient and efficient.

Comprehensive Review of One’s Debt Landscape

Navigating the intricacies of the debt landscape is essential for maintaining financial health. Every individual’s economic situation is unique, and understanding this terrain involves a deep dive into personal debt profiles, which can include a myriad of credit cards, loans, and other financial obligations. By conducting a thorough review, individuals can strategize action plans that not only alleviate debt burdens but also pave the way towards greater financial freedom. Credit counseling services often emphasize the critical step of comprehensively evaluating one’s debts as a keystone of effective debt management.

Identifying High-Interest Debt

Among the first critical steps in analyzing the debt landscape is to identify and prioritize the repayment of high-interest debt. These debts are more costly over time, hindering the ability to achieve financial stability. It’s not uncommon for individuals to juggle various credit obligations, but high-interest rates, often associated with credit card balances, should be addressed promptly to avoid spiraling costs.

Understanding Credit Utilization and its Effects

Credit utilization plays a pivotal role in one’s credit score—a key barometer of financial health. A high credit utilization ratio can indicate overreliance on credit and potential risks to creditors. Conversely, low utilization with timely repayments signifies responsible credit management and can positively affect credit scores. Finding equilibrium in credit usage is instrumental in cultivating a robust financial standing.

| Debt Type | Interest Rate | Credit Limit | Utilization | Minimum Payment | Priority |

|---|---|---|---|---|---|

| Credit Card A | 22% | $10,000 | 75% | $200 | High |

| Credit Card B | 18% | $5,000 | 30% | $100 | Medium |

| Personal Loan | 9% | N/A | N/A | $250 | Low |

| Car Loan | 3.5% | N/A | N/A | $300 | Low |

An in-depth analysis of one’s debt not only averts the pitfalls of financial strain but also aligns with wealth-building aspirations. Whether navigating repayments independently or seeking expert debt counseling, a thorough examination and subsequent handling of one’s debt landscape marks the cornerstone of sustainable financial practice.

Smart Consolidation Choices for Efficient Debt Management

Debt consolidation stands as a beacon of hope for many grappling with multiple debts, offering a path to simpler monthly payments and potentially lower interest rates. However, traversing this path requires a strategic approach to ensure it leads to a stronger financial position. Here’s a look at vital considerations when evaluating the best way to consolidate and manage your debts.

Evaluating Debt Consolidation Options

Understanding the various options available for debt consolidation is crucial. This decision can affect your financial future, from how you manage your cash flow to the total interest you pay over time. When looking at consolidation, it’s important to evaluate not just the interest rate, but also the term of the new loan, fees, and any potential impacts on credit score. A careful review of these details helps in determining the most beneficial consolidation path.

Considering Personal Loans and Balance Transfers

When considering personal loans for debt consolidation, these instruments can provide a lower interest rate compared to high-interest credit card debts. It’s essential, however, to factor in origination fees and ensure the repayment terms align with your financial goals. Similarly, balance transfers to a new credit card with a 0% introductory APR offer can be enticing, but it’s paramount to have a plan to pay off the balance before the promotional period ends, to avoid facing even higher rates thereafter.

Whether opting for debt consolidation through personal loans or utilizing balance transfers, proper debt management practices post-consolidation are key. This includes maintaining a budget to avoid falling back into debt, monitoring credit regularly, and adjusting spending habits as necessary. The aim is not just to consolidate, but also to create a sustainable financial foundation moving forward.

Conclusion

As we reach the conclusion of our journey through effective debt management techniques, it is clear that the path to financial stability is marked by consistent and informed efforts. From staying on top of bill payments to tackling high-interest debt head-on, and ensuring minimum payments to strategic debt consolidation, each tactic plays a crucial role. Accordingly, crafting and adhering to a meticulous financial plan is a cornerstone of successful debt management.

Summarizing Effective Debt Management Practices

Debt management extends beyond mere repayments; it is a holistic approach that involves careful financial planning and diligent tracking. By adhering to the key practices outlined, such as prioritizing debts and maintaining a schedule of timely payments, individuals can navigate through their financial obligations with clarity and confidence. Moreover, employing credit counseling services can provide the tailored debt help necessary for those looking to manage their finances more effectively.

Encouragement for Persistent and Proactive Financial Planning

Ultimately, the goal is not just to manage debt, but to thrive financially. This requires ongoing commitment, a proactive stance in financial decision-making, and the resilience to persist through challenges. The long-term benefits of disciplined debt management are profound and enable individuals to create a more secure and prosperous future. With these strategies in hand, success in overcoming debt and achieving financial stability is not only possible; it is within reach.

FAQ

What are effective debt management strategies?

Effective debt management strategies include timely bill payments, prioritizing high-interest debts using the avalanche method, ensuring minimum payments on all debts, conducting a comprehensive assessment of your financial obligations, establishing an emergency fund for unexpected expenses, and seeking debt relief through consolidation or credit counseling. Additionally, a meticulous financial planning routine and persistent reduction of debt balances contribute to long-term financial stability.

Why is managing your debt important?

Managing debt is crucial for maintaining financial health, avoiding late fees, increased interest costs, and preventing damage to your credit score. Good debt management allows you to take advantage of future opportunities, like better loan interest rates, leading to savings and provides peace of mind knowing your financial commitments are under control.

How can timely bill payments benefit my financial situation?

Timely bill payments help in maintaining financial stability, reducing the risk of accruing late fees, avoiding higher interest charges, and maintaining a good credit score. This is a cornerstone of effective debt solutions and is crucial in achieving financial well-being.

What is the avalanche method in debt repayment?

The avalanche method is a debt repayment strategy that involves paying off high-interest debts first while making minimum payments on other debts. This approach helps to reduce the amount of interest that accrues over time and can lead to faster debt reduction.

How essential is it to make at least the minimum payments on debts?

Making at least the minimum payments on your debts each month is critical to avoid fees, penalty interest rates, and negative impacts on your credit score. While minimum payments keep your account in good standing, paying more than the minimum is recommended to reduce the principal balance more quickly.

What should be included in a comprehensive debt assessment?

A comprehensive debt assessment should include an inventory of all your debts, such as credit card balances, student loans, and mortgages. It should detail the balances owed, interest rates, minimum monthly payments, and due dates. This inventory is essential for creating a clear financial obligations portrait and prioritizing debt repayment efforts.

How does an emergency fund help with debt management?

An emergency fund acts as a financial buffer for unexpected costs, preventing you from taking on additional debt to cover surprise expenses. It is recommended to save an amount that covers three to six months’ worth of living expenses as part of a robust financial planning regimen.

Why should I repay more than the minimum requirements on my debt?

Repaying more than the minimum requirements on your debt can significantly reduce the principal balance, save you on interest in the long run, and help you become debt-free sooner. This proactive approach enhances your overall financial health and stability.

How can I rebuild my credit after having debt issues?

To rebuild credit after debt issues, it’s important to maintain consistent on-time payments, reduce your credit utilization, keep a diverse credit mix, and limit new credit inquiries. Secured credit cards and credit builder loans can be useful for re-establishing a healthier credit history.

What is a HELOC and how can it help with debt consolidation?

A Home Equity Line of Credit (HELOC) is a financial tool that allows you to borrow against the equity in your home at a lower interest rate. It can be used for debt consolidation by paying off higher-interest debts, thus potentially simplifying payments and reducing interest costs over time.

How can personal checking accounts aid in debt management?

Personal checking accounts offer various features to help track expenses, set up account alerts, and utilize budgeting tools. By monitoring and categorizing expenses, you can identify areas to cut back on spending, thus freeing up more funds for effective debt repayment.

What are FNCB Bank’s tools for financial management?

FNCB Bank offers a variety of financial management tools including personal checking accounts with features designed to streamline the tracking of daily financial transactions, which can assist in efficient debt management and budgeting.

What does a comprehensive review of my debt landscape involve?

A comprehensive review of your debt landscape involves identifying high-interest obligations, understanding the impact of credit utilization on your credit score, keeping debt-to-income ratios in check, and managing credit limits effectively. This assessment is key to responsible financial health management.

When is debt consolidation a smart choice?

Debt consolidation is a smart choice if it consolidates multiple high-interest loans into a single lower-interest loan, making payments easier to manage. It may also be beneficial if using low-interest personal loans to pay off high-interest credit card balances. However, it’s vital to consider the impact of consolidation on aspects such as federal loan forgiveness eligibility before making a decision.