When it comes to managing your credit, understanding the optimal credit utilization ratio is crucial. Your credit utilization ratio measures the percentage of your available credit that you are actively using. It is an important factor that credit scoring models consider when calculating your credit score. So, how much credit utilization is considered good? Let’s find out.

Key Takeaways:

- The ideal credit utilization ratio is between 1% to 10%.

- A good credit utilization ratio is anything below 30%.

- Keeping your total credit utilization below 30% is more impactful on your credit score.

- Credit utilization between 1% and 9% is considered ideal.

- Credit utilization at 10% to 29% is still acceptable but not as optimal.

Understanding Credit Utilization Ratios

Credit utilization, also known as credit utilization ratio, measures the percentage of your available credit that you are actively using. It is calculated by dividing your credit card balance by your credit limit and multiplying by 100.

Keeping your credit utilization rate low is important for maintaining a good credit score. Financial experts generally recommend keeping your credit utilization below 30% to optimize your credit score, although recent research suggests that a utilization rate of 10% or less may be even better for achieving an excellent score.

It is important to actively use and repay your line of credit, as a 0% utilization may not be as beneficial for your creditworthiness as a low utilization rate.

“A low credit utilization rate shows creditors that you are responsible and can handle credit without relying too heavily on it,” says financial expert Jane Harris.

H3: Credit Utilization Guidelines

- Maintain a credit utilization rate below 30% to optimize your credit score.

- Consider aiming for a utilization rate of 10% or less to achieve an excellent score.

- Regularly use and repay your line of credit.

By following these credit utilization best practices, you can improve your creditworthiness and increase your chances of accessing better financial opportunities.

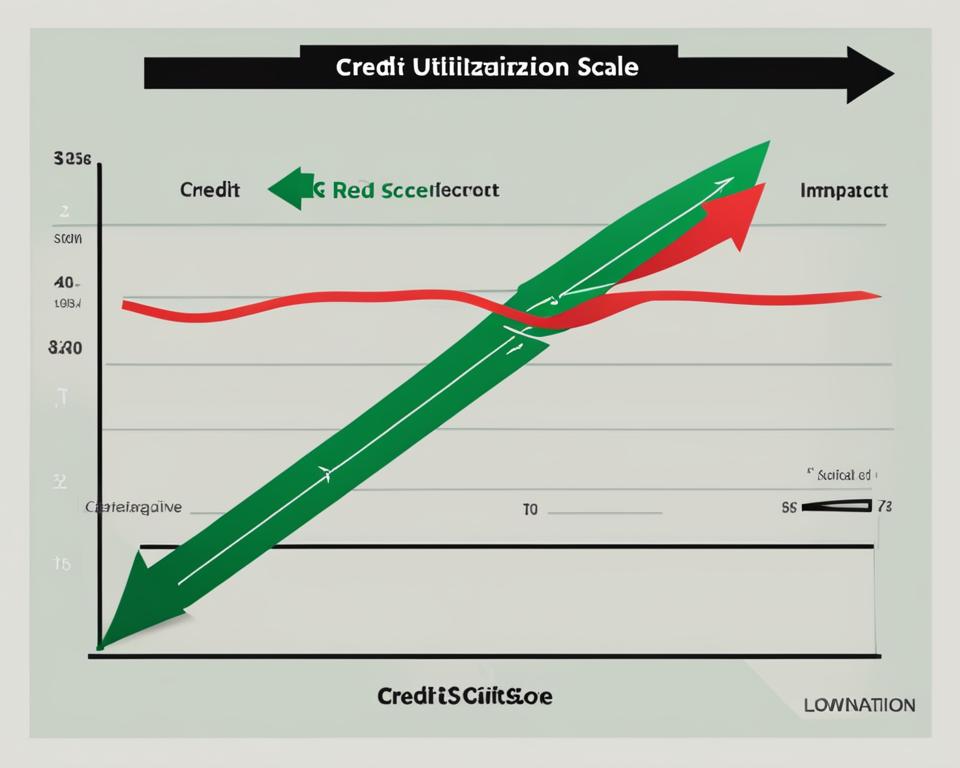

Impact of Credit Utilization on Credit Score

Your credit utilization plays a vital role in determining your credit score. When you use a high percentage of your available credit, it can have a negative impact on your score. On the other hand, keeping your credit utilization low can help improve your overall creditworthiness.

Credit card utilization is a significant factor considered by most credit scoring models, including FICO and VantageScore. FICO, for example, attributes 30% of your credit score to your credit utilization rate. It is important to note that there is no magic number for the ideal utilization rate, but it is generally recommended to keep it below 30% to achieve optimal credit scores.

Recent research, however, suggests that consumers with the highest credit scores tend to have lower utilization rates, typically around 7%. This finding indicates that maintaining a utilization rate well below the recommended benchmark can lead to even more favorable credit scores.

By minimizing your credit utilization, you demonstrate responsible credit behavior, which lenders and credit bureaus view positively. Lower utilization rates reflect your ability to manage credit responsibly and reduce the risk of defaulting on payments.

“Maintaining a low credit utilization rate is crucial for optimizing your credit score and showcasing your creditworthiness.”

While keeping your utilization rate low is essential, it’s equally important to actively use and repay your credit lines. A low utilization rate alone may not be as beneficial for your creditworthiness as building a track record of responsible credit usage.

In the next section, we will explore the other factors that influence your credit score, helping you understand the bigger picture of creditworthiness.

Factors Influencing Credit Scores

Credit utilization is just one factor that influences your credit score. Other important factors that can impact your credit score include payment history, amounts owed, length of credit history, new credit, and credit mix.

“Your credit utilization is important, but it’s not the only thing lenders look at when evaluating your creditworthiness.”

Payment history, which accounts for 35% of your FICO score, looks at your track record of making timely payments. This means that consistently paying your bills on time can significantly contribute to a positive credit score.

Next, amounts owed, which include credit utilization, make up 30% of your FICO score. This factor considers the total amount of debt you owe, including outstanding balances on credit cards and loans. Maintaining low balances and managing your credit utilization can positively impact this aspect of your credit score.

The length of your credit history also plays a role, accounting for 15% of your score. Lenders like to see a longer credit history as it demonstrates your experience with credit over time. If you are new to using credit, it may take some time to establish a substantial credit history.

New credit and credit mix, each accounting for 10% of your score, can also influence your creditworthiness. New credit considers any recent applications for credit, while credit mix looks at the different types of credit you have (e.g., credit cards, loans, mortgages). Having a diverse credit mix and avoiding multiple credit applications within a short period can positively impact these factors.

The Breakdown of Factors Influencing Credit Scores:

| Factor | Percentage Contribution |

|---|---|

| Payment History | 35% |

| Amounts Owed (Including Credit Utilization) | 30% |

| Length of Credit History | 15% |

| New Credit | 10% |

| Credit Mix | 10% |

While credit utilization is an important factor, it is crucial to understand that it is just one piece of the puzzle. By managing all these factors effectively, you can optimize your credit score and improve your overall creditworthiness.

Best Practices to Lower Credit Utilization

Lowering your credit utilization can have a positive impact on your credit score. By following these best practices, you can effectively lower your credit utilization and improve your overall creditworthiness.

- Pay your credit card balances in full and on time each month. This ensures that you are not carrying a balance from month to month, reducing your credit utilization to zero.

- Consider making multiple payments throughout the month to keep your utilization rate low. By dividing your payments into smaller amounts and making them more frequently, you can lower your credit utilization ratio and demonstrate responsible credit management.

- Use multiple credit cards to spread out your spending and lower your utilization on individual cards. Instead of relying heavily on a single credit card, consider using multiple cards for different expenses. This way, you can distribute your purchases across different credit limits, resulting in lower utilization rates for each card.

- Request a credit limit increase to lower your utilization rate. Contact your credit card issuer and ask for a credit limit increase. By increasing your available credit, you automatically decrease your credit utilization ratio.

- Monitor your utilization rate and adjust your spending accordingly to keep it below the recommended thresholds. Regularly review your credit card balances and credit limits to ensure that your utilization remains at a desirable level. If you notice your utilization creeping up, adjust your spending habits to bring it back down.

By implementing these best practices, you can effectively manage and lower your credit utilization, improving your credit score and increasing your chances of securing better credit opportunities in the future.

The Impact of Not Using Credit Cards

Not using your credit cards for an extended period of time may not have a significant impact on your credit score. However, it is generally recommended to use your credit cards responsibly to maintain a positive credit history. Some credit card issuers may lower your credit limit or even close your account due to inactivity. It is important to keep a small amount of activity on your credit cards by making occasional purchases and paying them off in full to demonstrate responsible credit behavior.

“Using credit cards responsibly is key to maintaining a positive credit history.”

While it may be tempting to avoid using credit cards altogether, especially to avoid accumulating debt, not using them can have unintended consequences. Credit card issuers rely on your credit activity to assess your creditworthiness and determine if you are a responsible borrower.

“Some credit card issuers may lower your credit limit or close your account due to inactivity.”

By not using your credit cards, you may be seen as a less profitable customer by credit card issuers. They may lower your credit limit or even close your account due to lack of activity. This can have an impact on your credit utilization rate, as your available credit decreases. Additionally, it can also affect your credit mix, one of the factors that influence your credit score.

“Keeping a small amount of activity on your credit cards demonstrates responsible credit behavior.”

While not using your credit cards for an extended period of time may not have a significant impact on your credit score, it is still advisable to keep a small amount of activity on your credit cards. Making occasional purchases and paying them off in full showcases responsible credit behavior and helps maintain a positive credit history.

Ultimately, the key is to strike a balance between responsible credit card usage and avoiding excessive debt. Using credit cards responsibly by making timely payments and keeping your utilization low can help you build and maintain a good credit score.

The Perfect Credit Utilization Ratio

When it comes to credit utilization ratio, there is no one-size-fits-all perfect ratio that applies to everyone. The ideal utilization rate varies depending on individual circumstances and the credit scoring models used by lenders.

While a utilization rate below 30% is commonly recommended for maintaining good credit scores, recent research suggests that consumers with the highest credit scores tend to have even lower utilization rates, around 7%. This indicates that keeping your utilization as low as possible can have a positive impact on your creditworthiness.

It is important to actively use and responsibly repay your credit lines to demonstrate good credit behavior. By keeping your utilization low, you show lenders that you are effectively managing your available credit and not relying too heavily on borrowed funds.

| Credit Utilization Ratio | Impact on Credit Scores |

|---|---|

| Below 30% | Recommended for good credit scores |

| Around 7% | Observed in consumers with the highest credit scores |

Remember, credit utilization is just one piece of the puzzle when it comes to your credit score. Other factors such as payment history, length of credit history, and credit mix also play important roles. It is crucial to maintain good credit habits across the board to build a strong credit profile and increase your chances of qualifying for the best credit card offers.

Ultimately, finding your perfect credit utilization ratio requires finding the balance that works best for your financial situation and goals. By actively monitoring and managing your credit utilization, you can take steps towards achieving a healthier credit score.

How to Decrease Credit Utilization

If you want to decrease your credit utilization, here are some strategies you can try:

- Pay your credit card balances in full and on time each month. Timely payments help reduce your outstanding balance and keep your utilization rate low. By paying off your balances in full, you can avoid carrying debt and decrease your credit utilization.

- Make multiple payments throughout the month to lower your balance and utilization rate. Instead of waiting for the due date, consider making extra payments during the billing cycle. This can help reduce your balance and decrease your overall credit utilization, resulting in a better credit score.

- Call your credit card issuers to determine the statement closing dates and time your payments accordingly. Knowing the specific dates when your credit card statements are generated can help you plan your payments strategically. By paying off your balances just before the statement closing dates, you can minimize your reported balances and lower your credit utilization ratio.

- Consider requesting a credit limit increase. A higher credit limit can provide you with more available credit, which in turn decreases your credit utilization ratio. However, be cautious as requesting a credit limit increase might result in a hard inquiry on your credit report.

- Use credit cards responsibly and avoid excessive spending to keep your utilization low. Spending within your means and using credit cards sparingly can help you maintain a low credit utilization ratio. Avoid unnecessary purchases and focus on using credit cards for essential expenses.

The Role of Tally in Credit Card Management

Tally’s credit card management app is a powerful tool that can help you effectively manage your credit card repayments and optimize your credit utilization rate. With Tally, you can consolidate all your credit card accounts in one convenient place, allowing you to stay organized and in control of your finances.

By using Tally’s app, you can monitor important details and deadlines for each of your credit cards, ensuring that you never miss a payment or incur late fees. Tally also provides valuable insights and recommendations to help you optimize your repayment methods, saving you money on interest charges.

One of the key features of Tally’s app is its ability to simplify your monthly credit card payments. Instead of making multiple payments to different card issuers, Tally enables you to make a single payment each month for all your accounts. This not only streamlines the payment process but also helps you stay on top of your obligations.

With Tally’s app, you can take control of your credit card debt and work towards paying it down faster. By effectively managing your credit utilization rate, you can lower your overall debt and improve your credit score. Tally’s app provides you with the visibility and tools you need to achieve these goals.

For a visual representation of the benefits of using Tally’s credit card management app, take a look at the table below:

| Benefits of Tally’s Credit Card Management App |

|---|

| Easily monitor your credit card accounts and deadlines |

| Optimize your repayment methods to save on interest charges |

| Simplify your monthly credit card payments |

| Lower your credit utilization rate and improve your credit score |

Tally’s credit card management app is a valuable tool that can help you stay on track with your credit card repayments and achieve your financial goals. Whether you’re looking to reduce your debt or improve your credit score, Tally’s app provides the support and guidance you need to succeed.

With Tally’s app, you can take control of your credit card debt and work towards paying it down faster. By effectively managing your credit utilization rate, you can lower your overall debt and improve your credit score. Tally’s app provides you with the visibility and tools you need to achieve these goals.

The Importance of Consistent Good Credit Habits

Consistently practicing good credit habits is essential for maintaining a good credit score. By adopting these habits, you can increase your creditworthiness and improve your chances of qualifying for the best credit card offers. Here are some key credit habits to keep in mind:

- Pay your credit card balances in full and on time: Timely payments demonstrate your financial responsibility and help build a positive credit history. Set up automatic payments or reminders to ensure you never miss a payment deadline.

- Keep your credit utilization low: Credit utilization refers to the percentage of your available credit that you’re using. Keeping it below 30% is generally recommended. This shows lenders that you’re using credit responsibly and not relying too heavily on borrowed funds.

- Manage all your credit accounts responsibly: This includes not only credit cards but also loans and other lines of credit. Make sure to make your payments on time and avoid taking on more credit than you can handle.

Adhering to these good credit habits consistently can have a positive impact on your credit score over time. It shows lenders that you are a responsible borrower who can be trusted with credit. By maintaining good credit habits, you’re setting yourself up for financial success and ensuring access to the best credit opportunities when you need them.

Why Consistency Matters

Consistency is key when it comes to forming good credit habits. Demonstrating responsible credit behavior over a long period shows lenders that you’re committed to maintaining a good credit score. It’s not enough to have a few months of good habits followed by periods of slacking off. Consistency builds a strong foundation for a solid credit history and helps you achieve long-term financial goals.

“Consistency is key when it comes to forming good credit habits.”

How Good Credit Habits Benefit You

Developing and maintaining good credit habits can have several advantages:

| Benefits of Good Credit Habits | Explanation |

|---|---|

| Lower interest rates on loans: | With a good credit score, you’re more likely to qualify for lower interest rates on loans, saving you money over time. |

| Access to better credit cards: | A good credit score increases your chances of being approved for credit cards with attractive rewards programs and perks. |

| Easier rental and job applications: | Many landlords and employers check credit history as part of their application process. Good credit habits can make these processes smoother for you. |

By maintaining good credit habits, you’re not only improving your creditworthiness but also setting yourself up for favorable financial opportunities in the future. It’s never too late to start practicing these habits and reaping the benefits they bring.

Conclusion

In conclusion, maintaining a low credit utilization ratio is crucial for optimizing your credit score. Experts generally recommend keeping your utilization below 30%, but recent research suggests that aiming for a utilization rate of 10% or less may yield an even better credit score. To achieve this, it is important to actively use your credit lines while keeping your utilization as low as possible.

By practicing good credit habits, such as paying your balances on time and in full, you can effectively manage your credit utilization. Additionally, monitoring your utilization rate regularly can help you stay on track and make necessary adjustments to maintain a healthy credit score.

Improving your creditworthiness not only enhances your financial standing but also opens doors to better credit card offers and loan opportunities. Keep in mind that maintaining consistent good credit habits is the key to long-term success. By demonstrating responsible credit behavior, you can secure a brighter financial future and enjoy the benefits of favorable credit scores.

FAQ

How much credit utilization is considered good?

The ideal credit utilization ratio is 1% to 10%. A good credit utilization ratio is anything below 30%.

What are the credit utilization ratio guidelines?

It is recommended to keep your total credit utilization below 30%. Using credit utilization between 1% and 9% is considered ideal, while 10% to 29% is still acceptable but not as optimal.

How does credit utilization impact credit scores?

Using a high percentage of your available credit can lower your score, while keeping your credit utilization low can help improve it.

What are the factors that influence credit scores?

Credit utilization is one of the factors that influence credit scores. Other important factors include payment history, amounts owed, length of credit history, new credit, and credit mix.

What are the best practices to lower credit utilization?

Some best practices to lower credit utilization include paying your credit card balances in full and on time, making multiple payments throughout the month to lower your balance, and using multiple credit cards to spread out your spending.

What is the impact of not using credit cards?

Not using your credit cards for an extended period of time may not have a significant impact on your credit score, but it is generally recommended to use them responsibly to maintain a positive credit history.

What is the perfect credit utilization ratio?

There is no one-size-fits-all perfect credit utilization ratio. The ideal utilization rate varies depending on individual circumstances and credit scoring models.

How can I decrease my credit utilization?

Strategies to decrease credit utilization include paying your credit card balances in full and on time, making multiple payments throughout the month, and requesting a credit limit increase.

What is the role of Tally in credit card management?

Tally is a credit card management app that helps you stay on top of your credit card repayments and manage your utilization rate. It consolidates all your credit card accounts in one place and allows you to monitor important details and deadlines.

How important are consistent good credit habits?

Consistently practicing good credit habits is essential for maintaining a good credit score and increasing your chances of qualifying for the best credit card offers.